Data from Glassnode shows that Bitcoin long-term holders have still been selling their coins at a loss in recent days.

Bitcoin Long-Term Holder SOPR Continues To Be At Values Below 1

According to the latest weekly report from Glassnode, bitcoin investors have been realizing losses for 9 months now. The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether the average holder in the Bitcoin market is selling their coins at a profit or loss right now.

When the value of this metric is greater than 1, it means the investors as a whole are harvesting some profits through their selling currently. On the other hand, values below the threshold imply the overall market has been participating in loss realization.

Naturally, the SOPR being exactly equal to 1 suggests the investors have been just breaking even on their investment, as the total amount of profits realized are equal to losses realized at this value.

One of the two main segments in the Bitcoin market is made up of the “long-term holders” (LTHs), who are investors that have been holding onto their coins since more than 155 days ago, without having moved or sold them. The counterpart cohort is the “short-term holder” (STH) group.

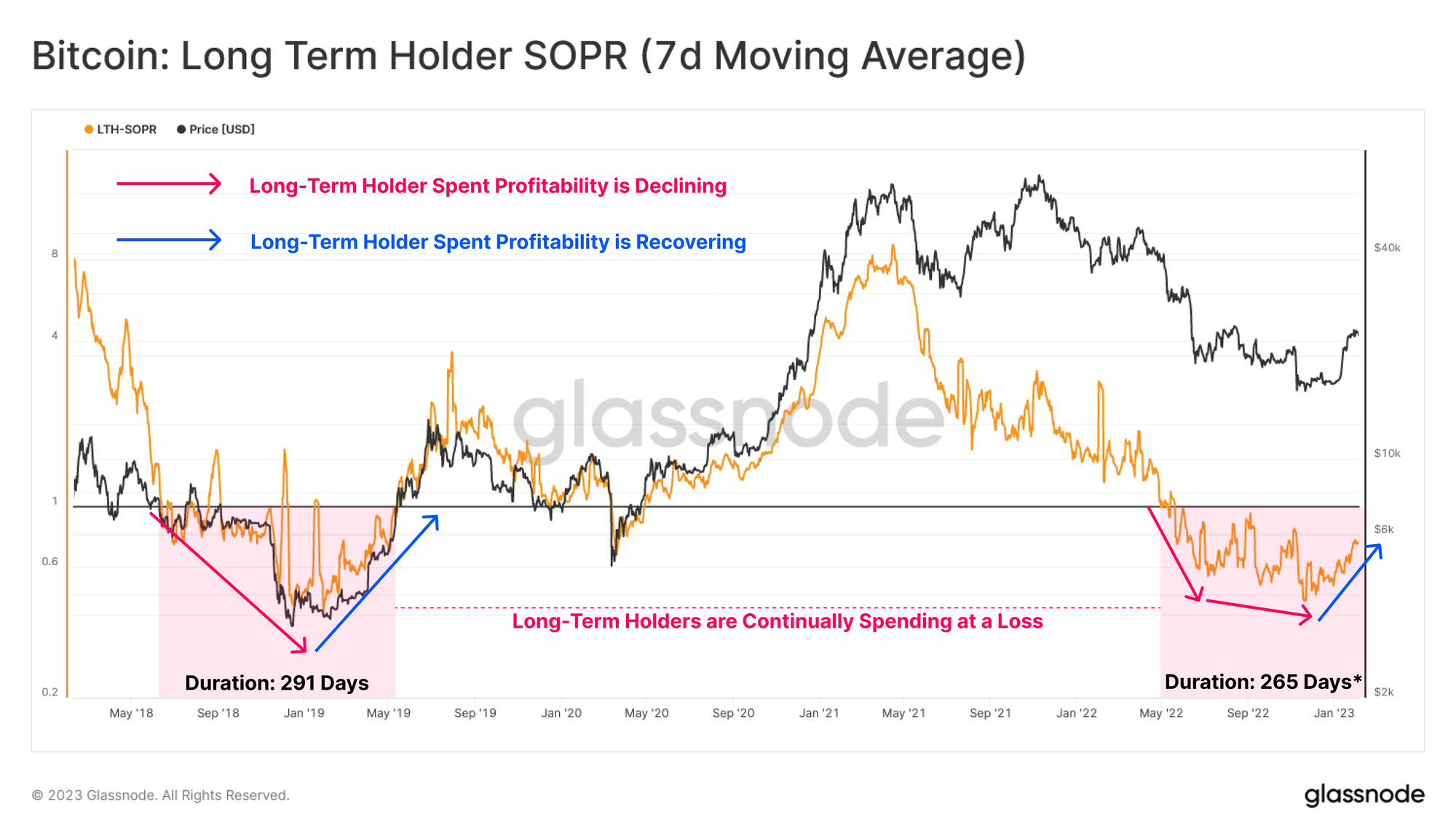

Now, here is a chart that shows the trend in the Bitcoin SOPR specifically for these LTHs over the last few years:

The value of the metric seems to have been climbing in recent days | Source: Glassnode's The Week Onchain - Week 6, 2023

As displayed in the above graph, the Bitcoin LTH SOPR had dropped below the 1 mark following the LUNA collapse last year and has stayed there since then. This means that these investors have been selling at losses throughout the bear market.

The chart has also highlighted the trend that the metric followed during the 2018-2019 bear market. It looks like the LTH SOPR also dropped below the break-even mark back then as well.

Generally, the investors who buy during bull markets and continue to hold until a bear market sets in (thus possibly maturing into becoming LTHs) enter into large losses as bull runs naturally offer relatively high acquisition prices.

Some of these holders inevitably capitulate as prices go lower during bearish periods and their losses become deeper. It’s because of this reason that the LTH SOPR sinks below 1 in such times.

In the 2018-2019 bear market, the Bitcoin LTHs continued to sell at losses for 291 days, before a rally similar to now pulled them back into profits. So far in the current cycle, the indicator has spent 265 days in this zone, which isn’t too far from the time spent there in the last cycle.

From the chart, it’s visible that the LTH SOPR seems to have been catching some uptrend recently (although it’s still obviously below 1 right now), which suggests that the latest rally may be slowly helping them recover.

BTC Price

At the time of writing, Bitcoin is trading around $22,900, up 1% in the last week.

BTC has declined in the last few days | Source: BTCUSD on TradingView

Featured image from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com