A closely followed veteran crypto trader thinks Ethereum (ETH) could drop lower to $1,268 before rebounding back up.

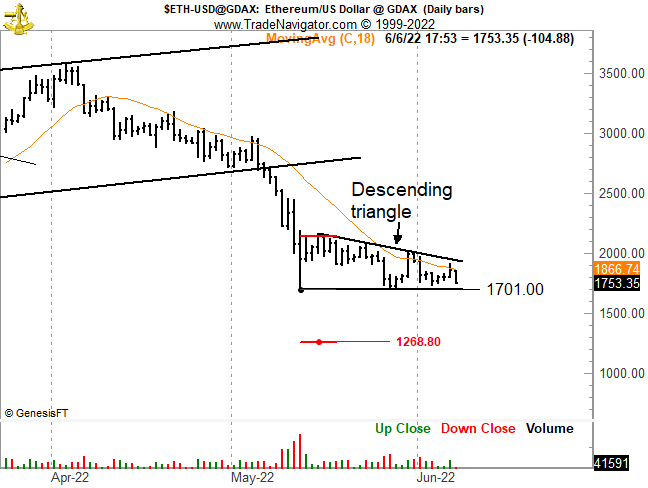

Peter Brand tells his 647,800 Twitter followers ETH may be in a descending triangle, a pattern indicative of further downside risk for the second-largest cryptocurrency by market capitalization.

Brandt first mentioned the possible descending triangle last week, saying ETH looked “like a good prospect for a measured risk short trade.”

On Monday, the trader shared a chart including a price target of $1,268 if ETH’s support of $1,700 gets taken out.

Ethereum is trading for $1,826 at time of writing, down more than 1% in the past 24 hours.

Not all traders are quite as bearish. Popular crypto analyst Justin Bennett tells his 101,000 Twitter followers that traders should pay attention to an ETH trend line from November.

Explains Bennett,

“A daily close above would open up higher levels like $2,150 and $2,350. $1,700 is support. Below that is the prior cycle peak around $1,400.”

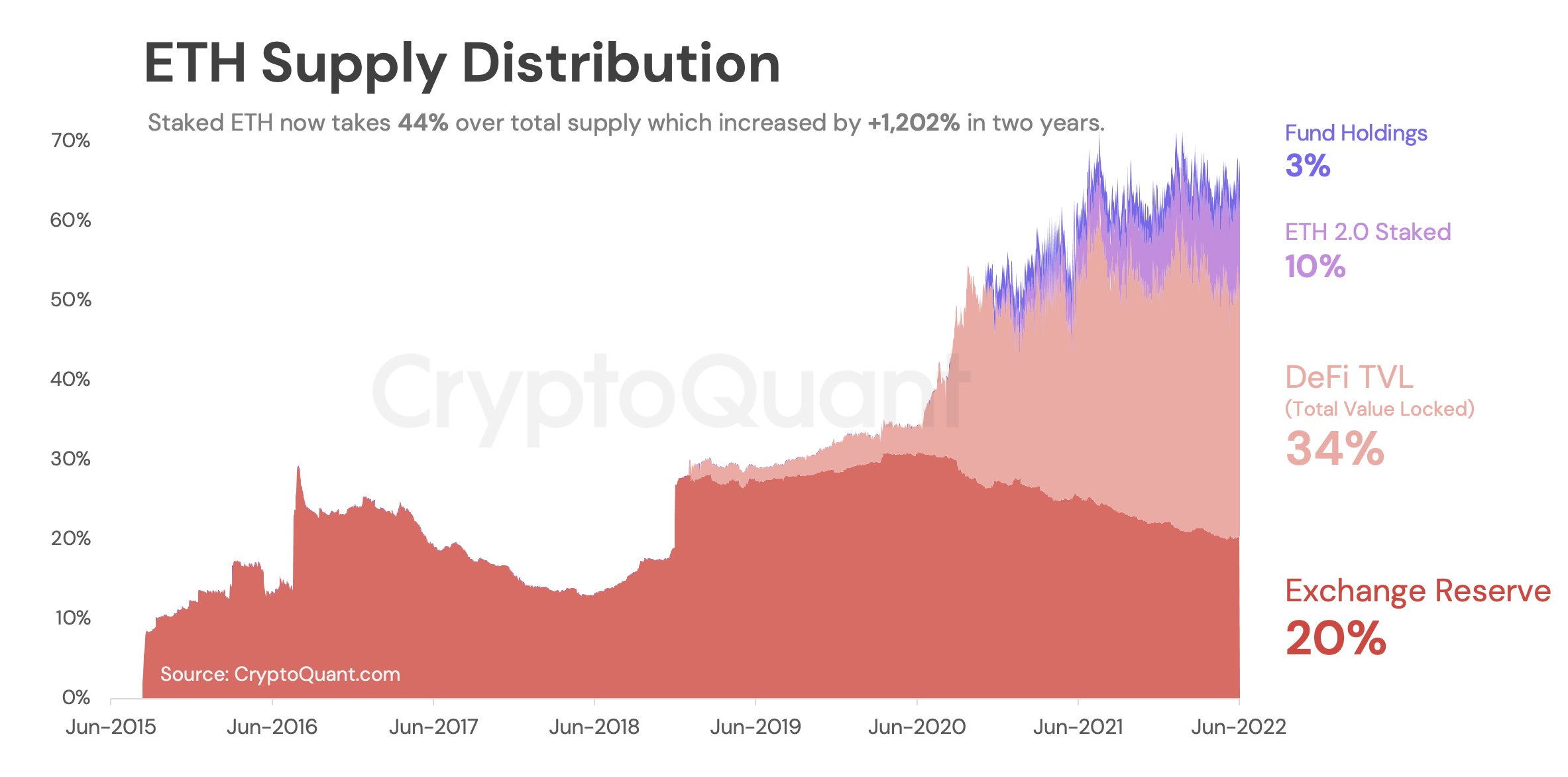

Ki Young Ju, chief executive of on-chain insights platform CryptoQuant, notes Ethereum’s ecosystem is still growing.

“Supply distribution differs from the 2019 bear market. Half of the supply is staked in DeFi [decentralized finance], ETH 2.0, etc. It reminds me that ETH had nothing but ICO [initial coin offering] back in 2019. I’m glad now people talk about fundamentals.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Joy Chakma