Summary

- We maintain a strong-sell rating on Bitcoin due to a lack of use cases other than trading and speculation.

- However, the risk/reward for blanket shorting Bitcoin is not as attractive as in 2021-2022.

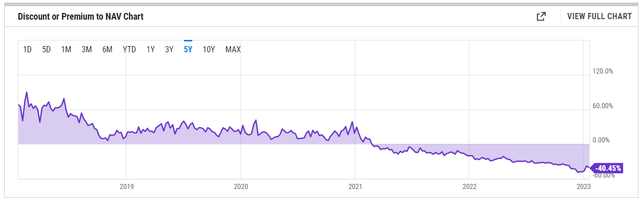

- We believe Grayscale Bitcoin Trust, a closed-ended Bitcoin Trust, with a ~40% discount to NAV is a good hedge for Bitcoin price appreciation.

- Bitcoin can be shorted through an ETF such as BITI or crypto trading platforms such as Coinbase or Binance.

tdub303

We maintain a strong-sell rating on Bitcoin

Previously, Biotechvalley Insights published a short thesis on cryptocurrencies on May 2021. We maintain a strong sell rating on Bitcoin (BTC-USD) as the fundamentals behind it have not changed; in fact, we believe it worsened with various negative news flow (i.e., Terra Luna (LUNC-USD), the FTX (FTT-USD) scandal, the bankruptcy of various cryptocurrency-related banks and hedge funds) plaguing the market sentiment and diminishing the trust around the crypto-hemisphere.

Long GBTC, short Bitcoin

After we published our article, as we expected, cryptocurrencies got obliterated, driven by rising interest rates and changes in market sentiment to risk-off investments, falling below $16,000 per Bitcoin at one point. Even though we do not intend to long any cryptocurrency at this time, we believe it is risky to short it at the current level as there could be a bear market rally considering the fact that Bitcoin price is heavily driven by retail trading. As such, we believe it is important to hedge your risk just in case there could be a volatile movement in bitcoin prices. We believe going long the Grayscale Bitcoin Trust (OTC:GBTC) and shorting Bitcoin through Coinbase (COIN) or a Binance (BNB-USD) account or Bitcoin-related ETFs to be an excellent pairs trade because of the following reasons. GBTC is currently at a ~40% discount to NAV, meaning that you can get a 40% discount on Bitcoin by buying GBTC compared to buying it in other vehicles (i.e., Coinbase or other Bitcoin ETFs); this means that if Bitcoin falls further, your short will gain at a similar rate as GBTC loses value, and if Bitcoin appreciates or somehow GBTC successfully converts into a spot ETF structure (with close to 0% discount to NAV), then the discount to NAV would narrow close to zero (in theory), which would constitute a 40% gain from the current level. We believe the chance of GBTC successfully converting to spot ETF is slim based on the recent comment from the SEC; however, even if that doesn’t happen, if Bitcoin appreciates in value, we believe the chance of the discount to NAV narrowing is high, making our thesis actionable for investors.

GBTC discount to NAV (Y Chart)

Risks to the investment thesis

However, this strategy does not come without risk, as there is always a lingering risk of the Grayscale Bitcoin Trust or Coinbase defaulting, and investors may lose all of their money. Furthermore, even in a potential scenario of Bitcoin’s price appreciation, there is a probability that the discount to NAV does not narrow down to 0% or perhaps fall due to an increase in competition from crypto-related stocks or other cryptocurrency futures ETFs. Considering the fact that both companies and instruments are public companies, we believe it is less likely to go bankrupt than private cryptocurrency-related enterprises such as Terra Luna or Sam Bankman-Fried’s FTX, which allegedly turned out to be a fraud. Furthermore, in the case of the Bitcoin price collapsing further, the discount to NAV widening more than the decline of Bitcoin price remains a concern; however, we believe the current level of discount to NAV is excessive even if we are bearish on Bitcoin and believe there is a higher chance of the discount narrowing than widening.

Conclusion

We continue to believe Bitcoin has close to no utility (and value) other than speculation and trading. We advise our readers to read our article on Bitcoin and cryptocurrency that we wrote in May 2021 for detailed analysis as many of the things we predicted have played out. However, due to the recent price decline in Bitcoin, naked shorting Bitcoin became riskier, and we believe going long GBTC and shorting Bitcoin through crypto exchanges to be a relatively low-risk arbitrage strategy for investors. We believe investors can profit or at least not lose money regardless of the movement in Bitcoin prices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

We publish unbiased long/short trade ideas. We focus on small and mid-cap healthcare and technology companies. If you have exciting investment ideas, please message us.Disclaimer: Biotechvalley Insights (BTVI) is not a FINRA-licensed investment advisor, and articles are not targeted toward retail investors. BTVI explicitly denies that his opinions are expert in any way. The reader is encouraged to review publicly available information and perform other research before determining whether they agree with the opinions of the author. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Biotechvalley Insight (BTVI) is a group of biotech/technology investors with a main interest in US-based small/mid-cap biotech companies and cryptocurrencies. We are not affiliated with any institution/company but an independent research organization of students/working professionals.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI’s ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.