travelview/iStock Editorial via Getty Images

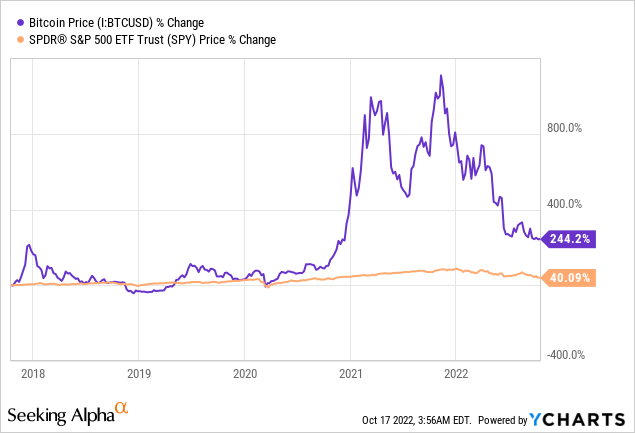

Investing was pretty easy in late 2020 and 2021–all many investors had to do was phone their bets in and collect their winnings. No group of investors did better than the crypto faithful, with investing in Bitcoin (BTC-USD) alone thought to account for around 1/3 of American millennials who had managed to achieve millionaire status by 2021. But of course, the tables turned in 2022 as markets were crushed by surging inflation. Bitcoin has fallen nearly 60% this year against the US dollar, more than the broad NASDAQ index (QQQ) and the S&P 500 (SPY). Things look bleak, but when you zoom out, I think it’s quite clear that the underlying reasons that Bitcoin has succeeded over the past 10 years are still in place, creating opportunities for patient investors.

Underneath the surface, there are a few things going on in the crypto world that have positive implications going forward.

1. Bitcoin’s Volatility Is Declining

First and foremost is the decline of volatility in Bitcoin. By nature, volatility ebbs and flows, but Bitcoin is becoming less volatile even while levels of volatility in stocks are sharply rising. Bloomberg recently reported on the decline of Bitcoin volatility from its prior range of around 100% annualized to about 70% annualized. This comes as the implied volatility of stocks (VIX) has risen to around 32% annualized, vs. a long-term historical average of about 16-17%. There are clearly some big changes to the underlying market structure of Bitcoin happening underneath the hood that are worth diving into. The author of the Bloomberg report quoted sources speculating that this is bad because it means that speculative demand is drying up, but BTC has been holding its own recently, hovering around the $19,000 to $20,000 level. In my opinion, this is an unquestionably good thing as it means that more people are holding Bitcoin as an investment, and fewer people are holding it as a speculative hot potato. Should volatility continue to decline, this means that investors can expect a smoother ride and likely a higher fair value as more people get comfortable allocating.

2. Emerging Market Adoption Of BTC Isn’t Going Away

Second, Bitcoin continues to be adopted globally. Of the top 20 countries for Bitcoin adoption, 18 are considered low or middle-income countries. Emerging market adoption is really the key to understanding the future of Bitcoin. Of the ~7.9 billion people on earth, less than 1 billion people live in developed countries. Outside of the developed world, hyperinflation is a common policy choice, and workers are effectively paid with rapidly-depreciating monopoly money. Controlling currency gives autocratic governments a tremendous ability to consolidate money and power in the hands of a few people. A lot of this money gets spent on pointless wars, mansions in London or Paris, and expensive toys for those in power.

Bitcoin is the opposite–it decentralizes power and represents an escape hatch for those in countries where hyperinflation is used as a way to steal from the population. The adoption stats show that people in rich countries are less interested in BTC now than they were a year ago and adoption there is falling, but the emerging market story continues to be a home run in terms of adoption. This may be a bit farsighted, but my guess is that over the next 20 years or so, Bitcoin and affordable solar energy will deprive the world’s dictators of their main two sources of money, which are hyperinflation and oil exports to Western countries. If we can make it to that point, the world becomes a much more peaceful place.

With the supply of BTC fixed at 21 million coins, we can think of Bitcoin not only as a tool for financial freedom but also as a network that can be valued not too differently than a tech stock. WhatsApp famously disrupted the global telecommunications industry, pushing fees for international calls from dollars per minute to zero for many customers. Before that, the internet disrupted old ways of communication, with deregulation and new tech tearing down barriers for freely calling to other states within the US. Through the developments of Bitcoin’s Lightning Network, BTC has the potential to massively disrupt the international money transfer industry, which makes fat fees from sending money from Western countries to places like Latin America, Southeast Asia, and the Middle East. And in authoritarian China, BTC continues to see use, despite the Party ostensibly banning it. And in Western countries, BTC remains a good hedge against central bank credibility — should there ever be a premature Fed pivot you can almost guarantee a rapid return to all-time highs for Bitcoin. Adding up all of this potential against Bitcoin’s market cap of roughly $370 billion, there’s a lot to like in the long run. The mainstream media is quick to make fun of El Salvador’s efforts to adopt Bitcoin, but the underlying reasons why they and other countries see potential in Bitcoin are structural and not going anywhere.

3. The Push To Get A Spot BTC ETF Continues

The ongoing thrust to get a spot Bitcoin ETF approved for US investors continues. Grayscale is leading the way with the push to get the Grayscale Bitcoin Trust (BTC)”>OTC:GBTC) converted into a spot Bitcoin ETF. If all that investors had to do in 2021 was call it in and win, the theme for 2022 seems to be legal gridlock and/or dysfunction.

Just a few examples:

- The drama around Elon Musk’s Twitter (TWTR) acquisition and the Delaware Court of Chancery

- The giant (but necessary) Fed pivot.

- The awful results of hundreds of SPACs that came public, showing that most forward guidance given by companies going public was expert salesmanship of garbage.

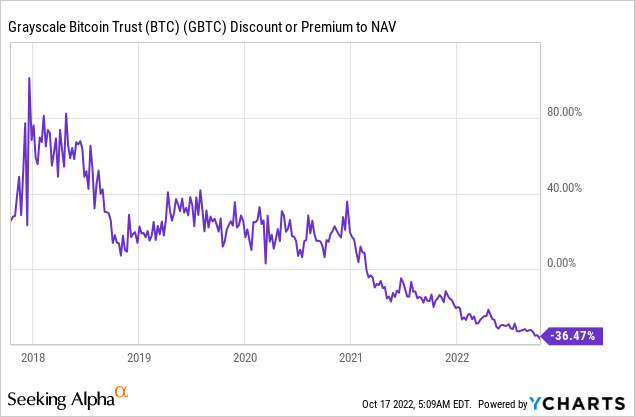

- Of course, GBTC has similarly been a frustrating play for different reasons, with Grayscale unable to get an ETF conversion over the goal line.

Grayscale filed its opening brief last week in Federal court, asking the court to overturn the SEC’s decision to deny GBTC from converting from a closed-end trust to an open-ended spot ETF. The case is highly technical. The government has concerns about the potential for market manipulation, while Grayscale points in part to the benefit that retail investors would have from a safe, institutional-grade way to hold BTC without having to worry about Bitcoin wallets or the technical side.

GBTC now trades for a crazy (nearly 37%) discount to its net asset value, after trading for as much as a 131% premium during the initial Bitcoin bull market in 2017. If they’re able to successfully convert GBTC into a spot ETF, this discount would mechanically be closed to zero. The problem is that before they can do it, they’re tied up in court. The SEC similarly denied WisdomTree’s Spot Bitcoin ETF application under similar circumstances.

I’ve written about the GBTC conversion potential several times over the last couple of years. Of course, I initially thought the discount was good at 16%. 37% seems absurd considering the underlying holdings are nothing more than Bitcoin.

A final ruling on the case is expected roughly within the next 9 months. D.C. is what it is, but the courts there are much more efficient than in places like California, where cases routinely take years to be decided. For my part, I think the market is simply too impatient here. Investors have increasingly asymmetrical upside in GBTC. I own some GBTC and think they’ll eventually prevail in getting their spot ETF. If you like Bitcoin, GBTC is the best way to play it in my opinion, offering roughly 56% upside on the conversion alone with a nine-month window. By contrast, GBTC’s annual fee is 2% of NAV, for a payoff of roughly 38-1 if they can succeed in court. Grayscale also has the option to buy back more stock on its own to help close the discount, something it has already done a little in the past.

4. Will Bitcoin Ever Be Banned? It’s Highly Unlikely

Here, I think it’s worth discussing some of the most recent criticisms of Bitcoin.

The most sensible criticism of BTC relates to the energy use of Bitcoin mining. This was a big issue with the industry that came to a head in 2021, as they were using exponentially more electricity as the price of Bitcoin rose, while the world was facing high-profile issues with keeping a constant supply of electricity. There have been high-profile issues with electricity from anywhere from Texas to China over the last 2 years. This likely played into the decision of China to ban Bitcoin mining in 2021 (of course, BTC mining continues underground).

Lyn Alden is a big proponent of crypto and writes occasionally on Seeking Alpha. She did an incredibly deep dive into Bitcoin’s energy usage on her website and why it isn’t likely to be a problem going forward. What’s also interesting is how Bitcoin has challenged global central banks and forced them to reconsider their stances on monetary policy.

The mainstream view is that Bitcoin is a waste of electricity and that it’s bad for the environment– but the revisionist view is that this was true for a few months until some reforms pushed mining to more sustainable sources of energy. The even more interesting question is whether stimulus and easy-money policies by the government were the true problems and Bitcoin’s electricity use was just a symptom! When you think about it, stimulus and printing money are what’s truly bad for the environment as they push people to spend and pollute, while tight monetary policy eases pressure on resources (see the years after 2008 for a good example). Would Bitcoin have skyrocketed nearly 7x in price in the same way if the Fed let the free market set interest rates? Probably not, because people would have no reason to shun the dollar if the Fed’s credibility wasn’t in question from 2019 to 2021.

Far from being threatened by a potential ban, it’s possible that Bitcoin itself acted to force the Federal Reserve and other global central banks to abandon bad monetary policies and end their interest rate repression policies. Of course, it’s difficult to prove a counterfactual. However, there are many reasons to believe that the public’s rapid loss of faith in the Federal Reserve and the existence of monetary alternatives forced the Fed to stop denying the obvious and move to crush inflation in 2022. The only way I see Bitcoin being challenged in the US and Europe if it were unjustifiably wasting a lot of electricity. Now with tighter monetary policy pushing down asset prices across the board, sustainable sources of electricity for mining, and a broad consensus for the use and virtues of cryptocurrency, it’s clear to me that Bitcoin is here to stay.

The other main criticism of crypto is that it is a hotbed for fraud. This is somewhat true. However, the fraud is not generally in Bitcoin, but rather in the broader world of altcoins. Of course, a bit of hangover persists from the Wild West days of crypto. The last couple of years were marked by high-profile failures in the altcoin area, like the sudden collapse of Terra (UST-USD) and Celsius (CEL-USD). Even Kim Kardashian recently got fined $1.26 million for promoting a junky altcoin to her massive Instagram following without acknowledging that she was paid for the promotion. My guess is that the 10,000+ altcoins in existence will continue to show little to no practical use. As liquidity drains away from the system due to tighter monetary policies, a lot of these nonsense altcoin projects are simply going to fade away into oblivion. In this cycle, there is at least one more major scandal in the crypto world, but it won’t be from Bitcoin itself.

Bottom Line

Bitcoin is in a down-cycle but I’m encouraged by the lessening of volatility seen in BTC. Emerging market adoption will continue to drive Bitcoin’s value as a network. Industry players continue to push to get a spot Bitcoin ETF approved for investors, and I have faith that they will eventually succeed. Bitcoin has shown resilience even as stocks fall, showing some signs that it may be nearer to bottoming than bears think. My guess is that as liquidity drains from the system, BTC will bottom lower than the previous low of around 18,000 dollars this year before starting another bull run. To this point, investors should spread their purchases out. But in the long run, the fair value should be multiples of what it is today. If you’re a believer, I feel the best way to express this is to buy some GBTC, which offers roughly 56% upside to Bitcoin itself if Grayscale is able to win approval in court. The discount to NAV for GBTC has persisted, but this trade is cheaper than ever and now has even better upside. For those with some faith in the courts sorting out the ETF issue, GBTC is as compelling a buy as ever.

This article was written by

Author and entrepreneur. My articles typically cover macroeconomic trends, portfolio strategy, value investing, and behavioral finance. I like to profit from the biases and constraints of other investors. Feel free to read more of my work here.

Disclosure: I/we have a beneficial long position in the shares of GBTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.