Bitcoin (BTC) briefly jumped about 1% after minutes from the Federal Reserve’s November meeting showed that the majority of central bankers prefer a slower pace of rate hikes going forward.

“A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate,” the minutes stated. “The uncertain lags and magnitudes associated with the effects of monetary policy actions on economic activity and inflation were among the reasons cited regarding why such an assessment was important.”

Bitcoin rose from $16,448 to $16,565 after the report was released at 2 p.m. ET but the bigger chunk of those gains was quickly retracted. As of press time, the largest cryptocurrency was changing hands around $16,429.

Members of the Federal Open Market Committee (FOMC) decided to raise interest rates by 75 basis points, or a 0.75 percentage point, in November – the fourth rate hike of this magnitude – but Fed Chair Jerome Powell said in a press conference after the decision that a slower pace would be appropriate soon.

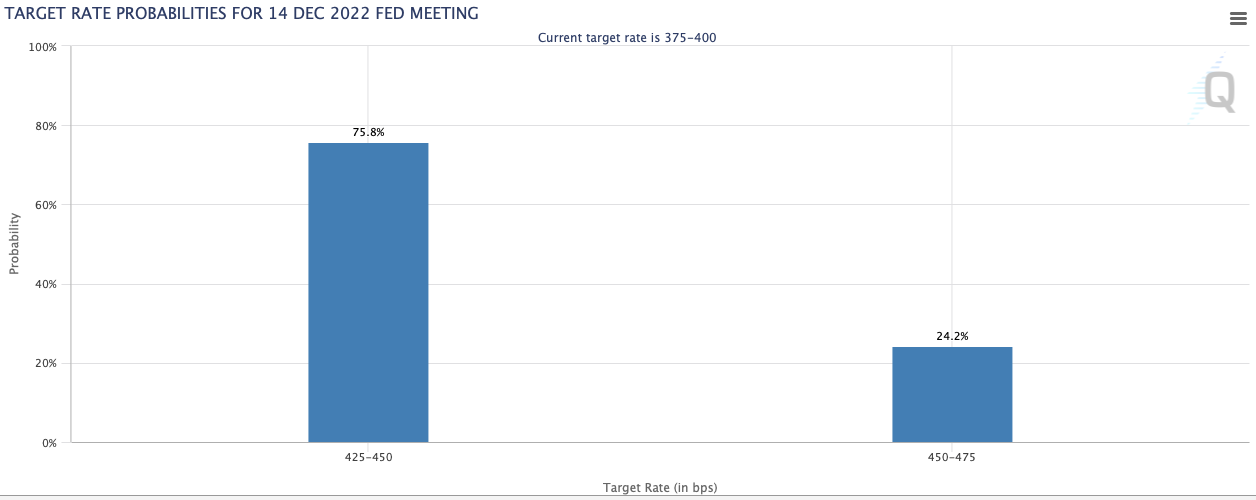

Traders in futures contracts on federal funds on the Chicago Mercantile Exchange (CME) now see an 75% chance that the Fed will move ahead with a 50 basis point hike at the next meeting on Dec. 13-14, and a 25 basis point increase at the first two meetings in 2023.

Traders in futures contracts on federal funds on the Chicago Mercantile Exchange (CME) now see an 75% chance that the Fed will move ahead with a 50 basis point hike at the next meeting. (Source: CME)

Central bankers have previously said that while they will likely bring down the pace of rate hikes soon, that doesn’t mean that the terminal rate will be lower as well.

However, they are still in disagreement about how high rates will eventually be. Goldman Sachs economists expect rates to peak at 5% in March.

Sign up for Crypto for Advisors, our weekly newsletter defining crypto, digital assets and the future of finance.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.