Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds. He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

Bitcoin’s price now correlates more strongly to copper futures than to traditional equity indexes.

BTC’s correlation coefficient relative to copper has risen to 0.84 from 0.27 a month ago, reaching its highest mark since August.

The correlation coefficient measures the pricing relationship between two assets, ranging from -1 to 1. The former indicates an inverse relationship, while the latter implies a direct pricing relationship.

The tightening relationship poses a couple of questions.

-

Analysts often view copper as a proxy for overall economic growth, affectionately calling it “Dr. Copper” for its professorial ability to forecast trends. Does this imply that the macro narrative within the digital asset space will continue?

-

Why has traditional equities’ relationship with copper weakened over the last two months? As early as Oct 6, the S&P 500’s correlation was as high as 0.86 before falling to its current level of 0.14.

On question one, I would say, yes. Absent a black swan or negative contagion event specific to a centralized entity, digital assets still seem very much connected to macroeconomic developments.

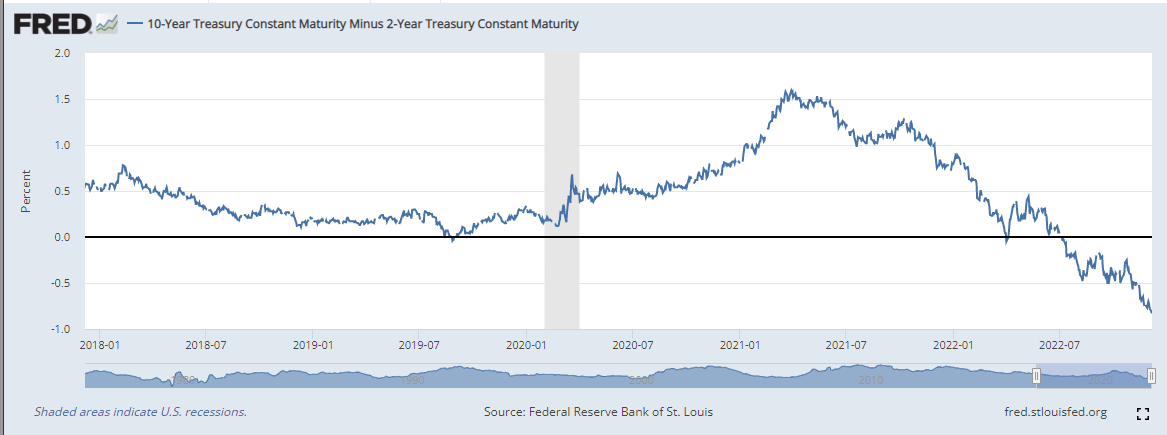

But, notably, yields for the federal funds rate, U.S. three-month and two-year Treasurys exceed the yield of 10-year Treasurys.

10-year Treasury Constant Maturity Minus 2-Year Constant Maturity (Fred Database)

This condition, called an inverted yield curve, has predated past economic recessions. If viewed in isolation, an inverted yield curve does not bode well for bitcoin, or copper prices for that matter. Increased short-term rates and slower economic growth lead to lower demand and prices for physical and digital assets.

Copper’s individual chart is not nearly as gloomy, however.

The metal’s price has increased close to 3% over the last month on increasing momentum and steady volume. Its 10-day moving average is north of its 100-day moving average as well, which is a bullish sign.

Copper Dec. 7, 2022 (TradingView)

On point two, equities may be trading at an unjustified premium at the moment. A CoinDesk article on Tuesday highlighted how equities trading has been unaligned to fundamental data, decoupling from its normal relationship with the two-year Treasury bond yield.

Given the decoupling and the price of copper itself, traders may be expecting a reversion to equities, and may place trades accordingly.

Unfortunately, bitcoin traders currently don’t have much cause for optimism about short-term price appreciation.

Prices have been noticeably range-bound for the last 30 days, and appear poised to continue that way.

Sentiment has followed the same pattern, and the Crypto Fear and Greed Index, which has occupied extreme fear and fear territory for months, aligns with September figures.

For long-term accumulators of bitcoin, however, this is likely their season. The increased connection to macro factors has provided stable (if not sluggish) price activity for the asset, providing investors with additional opportunities for accumulation.

Sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds. He owns BTC, ETH, UNI, DOT, MATIC, and AVAX