Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds. He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

After last month’s extreme market plunge as Sam Bankman-Fried’s FTX exchange collapsed, some traders might be grateful for a bit of respite – in the form of a sideways-trading market.

Both bitcoin (BTC) and ether (ETH) were essentially flat over the last week, with the two largest cryptocurrencies by market value trading .005% and .006% higher than the last recorded price on Dec. 2. Volume for both has been stable, with trading activity falling slightly below their respective 20-day moving averages.

BTC appears to be bumping up against potential resistance at current levels. A look at the asset’s Volume Profile Visible Range (VPVR) indicator indicates high levels of price agreement at current levels, which can lead to static price movement. If BTC breaks above this level, the next high volume node appears at the $20,000 level.

ETH’s price, since hitting a short-term bottom on Nov. 22 is showing the early makings of a potential uptrend, with prices up 12% since that day. A distinction between ETH and BTC’s recent price action is that ETH has pushed past a high volume node at $1,200 with the next stop above being at $1,340.

Bitcoin Dec. 9, 2022 (TradingView)

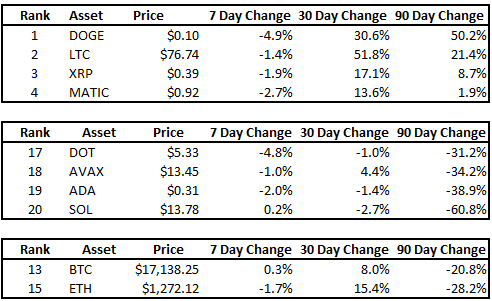

Among the top 20 cryptocurrencies by market capitalization, your 90-day winners are dogecoin (DOGE), litecoin (LTC), XRP and Polygon’s MATIC.

The laggards are Polkadot’s DOT, Avalanche’s AVAX, Cardano’s ADA and Solana’s SOL.

Bitcoin and ether are near the middle of the range, ranking 13th and 15th, respectively.

Each leader is down versus the U.S. dollar over the last seven days, as are the laggards, except for SOL.

Rankings Dec. 9, 2022 (Messari/Coindesk)

Bitcoin and ether prices remain tightly correlated at 0.96. Despite the differences between the two assets in supply, consensus mechanism, and utility, their prices continue to move in tandem. Other bitcoin correlations of note include:

-

Bitcoin to the U.S. dollar: Bitcoin’s correlation with the U.S. dollar index continues to move deeper into inversely correlated territory. This has been the norm for much of 2022, reversing only recently following FTX related contagion

-

Bitcoin to copper: Bitcoin’s correlation with copper futures continues to grow stronger with its coefficient increasing to 0.88. The linkage to copper implies a growing alignment between BTC and overall U.S. economic prospects.

-

Bitcoin to the S&P 500: Bitcoin’s correlation with the S&P 500 has weakened to 0.33. For the bulk of 2022, Bitcoin and equities have traded in lockstep, but the relationship has weakened lately.

The upcoming week will have its share of headline-worthy moments.

On Dec. 13, the U.S. House Financial Services Committee will hold part 1 of a hearing titled “Investigating the Collapse of FTX.” The embattled former CEO of FTX, Sam Bankman-Fried, has agreed to testify before the committee, following the threat of a subpoena.

The Senate Banking Committee will be holding its own FTX hearing the following day. Whether Bankman-Fried appears remains unclear.

The threat of a Senate subpoena may have a similar effect to the House Financial Service Committee’s action.

The impact of these events on crypto prices will be long term and connected to legislation arising from each committee’s findings.

The Federal Reserve’s Federal Open Market Committee (FOMC) meeting on Dec. 14 may have a more immediate effect, although markets seem to have already priced in a 50-basis point rate hike. Investors will likely be eyeing the Fed funds futures rate curve following the meeting.

Currently, markets anticipate that rates will reach 5% during the second and third quarters of 2023.

Sign up for Crypto for Advisors, our weekly newsletter defining crypto, digital assets and the future of finance.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds. He owns BTC, ETH, UNI, DOT, MATIC, and AVAX