Max Good, senior index research analyst at CoinDesk Indices, contributed writing for this report.

We thank our former intern, Zad Mahana, for his expertise and assistance in all aspects of our work on Digital Asset Classification Standard (DACS) and for his help in writing this paper.

In December 2021, CoinDesk Indices launched its Digital Asset Classification Standard (DACS) to set the standard for defining the industries of digital assets. Every one of the top 500 digital assets by market capitalization is assigned to an industry, defined by DACS. Then at least one industry is assigned to an industry group and finally at least one industry group is assigned to a sector.

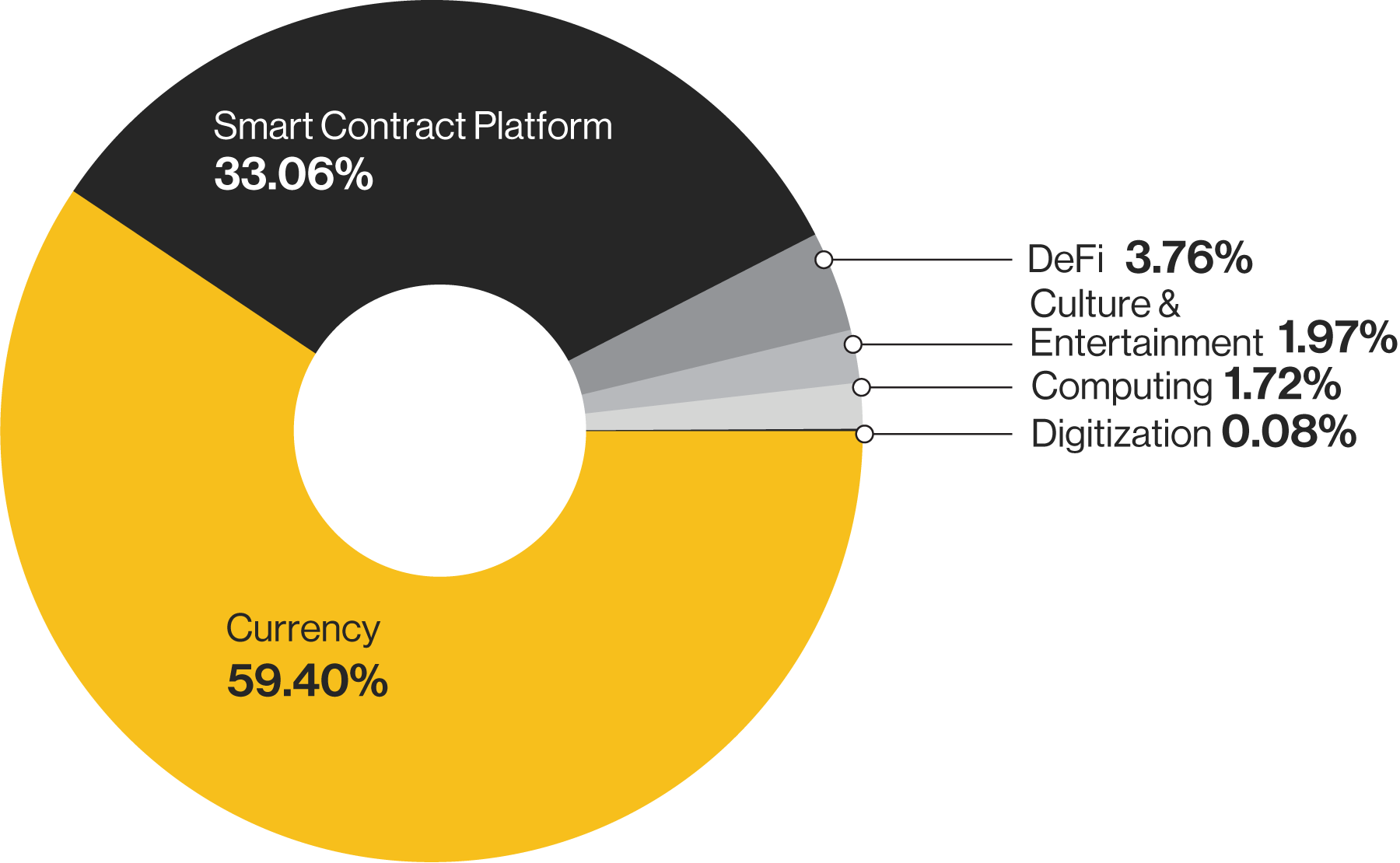

Currently, there are six sectors defined by DACS including Currency, Computing, DeFi (Decentralized Finance), Digitization, Entertainment and Smart Contract Platform. The Digitization sector is the smallest sector in DACS with nine assets representing 0.1% of the digital asset market worth approximately $1.4 billion in market capitalization as of April 30, 2022.

Exhibit 1: CoinDesk Indices DACS

(CoinDesk Indices, 5/13/2022. Market capitalization data is based on 4/30/2022.)

In this paper, we describe the Digitization sector in further detail by discussing its definition, constituents, and significance in the broader digital asset space.

Defining the Digitization sector

Digitization refers to the transformation of publicly verifiable ownership, identity, and immutability enabled by blockchain technology. With the growth of the digital economy and crypto native ecosystems, participants increasingly need a way to express their digital identity to facilitate fast, verifiable and censorship-resistant transactions on the blockchain. Although Digitization is currently the smallest sector in DACS, it has a wide range of use cases, including helping brands establish digital identity, accept crypto payments directly, and allow patients to digitize their medical records to enable faster exchange of information without loss of privacy.

The DACS Glossary defines the Digitization sector as follows:

Digitization refers to the process by which real world documents, contracts, public names, etc. are uploaded to a blockchain for the purpose of transparency, publicly verifiable ownership, and immutability. Proof of ownership, identity and authenticity are all valuable traits that are made possible by blockchain technology.

Industry groups and industries inside the Digitization sector

The Digitization industry is comprised of one industry group. The industry group is also comprised of one industry. As the digital economy grows, it is likely the digitization sector will expand with more industry groups and industries as the use cases become more specialized.

Exhibit 2: Industry Groups under Digitization Sector

|

Industry Group |

Market Capitalization ($) |

Number of Assets |

% of Market Capitalization |

|---|---|---|---|

|

Digitization |

1,436,859,943 |

9 |

100 |

CoinDesk Indices, 5/13/2022. Market capitalization data is based on 4/30/2022.

Major assets inside the Digitization sector

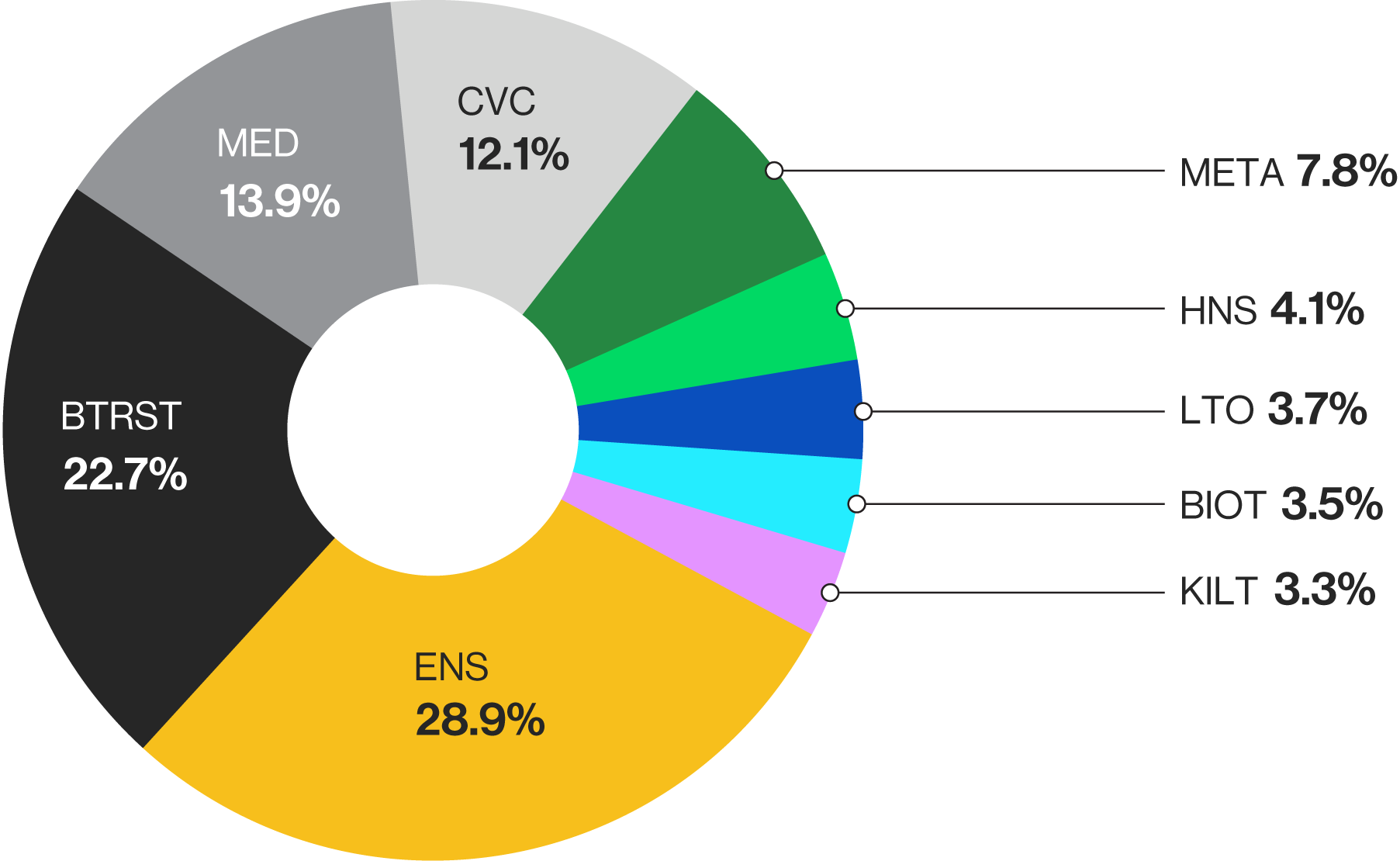

There are currently nine assets in the Digitization Sector. The largest three tokens in the sector are: Ethereum Name Service (ENS) 1, Braintrust (BTRST) 2 and MediBloc (MED) 3 representing 28.9%, 22.7% and 13.9% of the sector market capitalization, respectively, as of April 30.

Exhibit 3: Assets Inside the DACS Digitization Sector

(CoinDesk Indices, 5/13/2022. Market capitalization data is based on 4/30/2022.)

The Digitization sector includes projects that enable the digital transformation of real-world documents, contracts, and identities. With blockchain technology, proof of ownership and authenticity can be achieved in a transparent, secure and trustless fashion. Although Digitization is currently the smallest sector in DACS, it is likely to grow with the increasing demand for establishing identities in the digital economy.

1. Ethereum Name Service (ENS) allows user to convert an alphanumeric public address to a recognizable domain name on the blockchain. ENS empowers brands to create their digital identity (ex: Adidas.eth, Nike.eth, Puma.eth) to allow for crypto payments. Large social media platforms are also publicly announcing future non-fungible token (NFT) profiles that will be linked to users’ Ethereum wallets. Naturally people will want to differentiate and customize their Ethereum address to be identifiable to all their followers and/or customers.

2. Braintrust (BTRST) is the first decentralized marketplace for talent that connects skilled workers with reputable brands looking to hire. Unlike many Web2 talent marketplaces, Braintrust allows workers to keep 100% of their earnings and even rewards users and referrals with the native BTRST token.

3. MediBloc decentralizes identity verification and simplifies the encrypted exchange of medical records. It has a proprietary DID (Decentralized Identifier) protocol that ensures producers of medical data can digitally issue signed credentials from a verified identity so that patients, and other data providers can connect faster.

CoinDesk Indices, Inc. (“CDI”) does not sponsor, endorse, sell, promote or manage any investment offered by any third party that seeks to provide an investment return based on the performance of any index.

CDI is neither an investment adviser nor a commodity trading adviser and makes no representation regarding the advisability of making an investment linked to any CDI index. CDI does not act as a fiduciary. A decision to invest in any asset linked to a CDI index should not be made in reliance on any of the statements set forth in this document or elsewhere by CDI.

All content contained or used in any CDI index (the “Content”) is owned by CDI and/or its third-party data providers and licensors, unless stated otherwise by CDI. CDI does not guarantee the accuracy, completeness, timeliness, adequacy, validity or availability of any of the Content. CDI is not responsible for any errors or omissions, regardless of the cause, in the results obtained from the use of any of the Content. CDI does not assume any obligation to update the Content following publication in any form or format.

© 2022 CoinDesk Indices, Inc. All rights reserved.

Sign up for Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

cookies, and

do not sell my personal information

has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies. CoinDesk is an independent operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.