- Riot Blockchain: Entry Into Crypto Mining Industry

- Riot Blockchain: Evolution And Roadmap

- Riot’s Initiative To Reduce Electric Cost

- Riot Acquires Whinstone

- Riot Stock Price Forecast: Price History

- Riot Stock Price Forecast: Technical Analysis

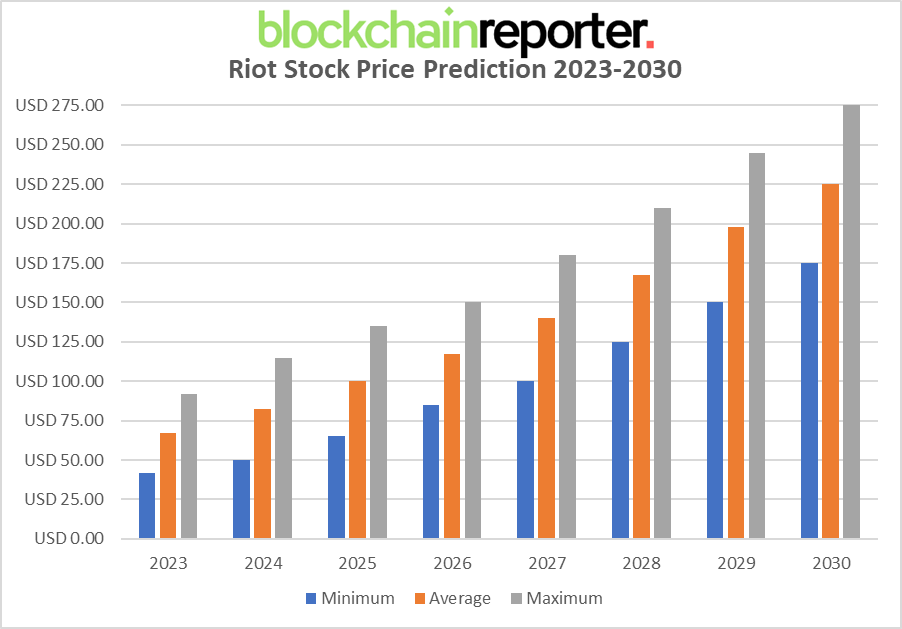

- Riot Stock Price Prediction By BlockchainReporter

- Riot Stock Price Prediction 2023

- Riot Stock Price Prediction 2024

- Riot Stock Price Prediction 2025

- Riot Stock Price Prediction 2026

- Riot Stock Price Prediction 2027

- Riot Stock Price Prediction 2028

- Riot Stock Price Prediction 2029

- Riot Stock Price Prediction 2030

- Riot Blockchain Stock Forecast: Industry Experts

- Riot Blockchain: Financial Outlook

- Conclusion

- FAQ

The financial world has witnessed a remarkable surge in cryptocurrency adoption, especially with the increased interest in Bitcoin. As digital currencies continue to gain popularity, the crypto mining industry has become a crucial cornerstone of the blockchain ecosystem. Riot Blockchain, a leading North American-based Bitcoin mining company, is at the forefront of this revolution. Riot Blockchain’s entry into the world of cryptocurrency mining in 2017 was impeccably timed. Since then, the company has rapidly grown to become a dominant player, reshaping the crypto mining ecosystem. Riot’s state-of-the-art mining facilities and robust infrastructure have established it as a force to be reckoned with. In an industry often criticized for its environmental impact, Riot Blockchain has emerged as a trailblazer for sustainable practices. The company’s commitment to renewable energy sources like hydroelectric and solar power has earned it a reputation as a green mining pioneer. However, the RIOT stock has witnessed a severe decline in the last few months, leaving investors questioning its future potential and market trends. Hence, our Riot blockchain stock forecast seeks to bring an in-depth analysis of the stock and its future potential to guide investors through a profitable investment plan.

Riot Blockchain: Entry Into Crypto Mining Industry

Riot Blockchain, a leading investment and development firm based in Castle Rock, Colorado, focuses on mining Bitcoin and other cryptocurrencies. It has risen to prominence as the largest mining company in America, boasting a Nasdaq listing as its success.

Founded in 2000 as a biotechnology company, Riot Blockchain pivoted its focus to cryptocurrency mining in 2017. The company’s strategic shift was timely, as it coincided with the exponential rise in the value of digital currencies. Riot Blockchain now operates a state-of-the-art mining facility in the United States, boasting an impressive fleet of mining hardware. The current CEO of the company is Jason Les.

Riot Blockchain was among multiple companies subpoenaed by the U.S. Securities and Exchange Commission (SEC) due to concerns regarding the inclusion of “blockchain” in their names without a clear connection to the industry. Although Riot Blockchain did pivot its business focus, it remained under SEC scrutiny for additional matters, leading to considerable upheaval among its board members and long-term investors.

Riot Blockchain, Inc. Announces Corporate Rebranding to Riot Platforms, Inc., Reflecting Increasingly Diversified, Bitcoin-Driven, Business Operations.

Read more in today’s press release: https://t.co/zEPk3cojFS.

— Riot Platforms, Inc. (@RiotPlatforms) January 3, 2023

On January 30, 2020, Riot Blockchain announced that the SEC’s Division of Enforcement had concluded its investigation and recommended no enforcement action against the company. Before moving further, let’s take a look at RIOT stock’s current market details to clarify our Riot blockchain stock forecast better.

| Company | Riot Platforms Inc |

| Stock Symbol | Riot |

| Price | $11.96 |

| 52 Week High | $14.4292 |

| 52 Week Low | $3.25 |

| Share Volume | 22,159,028 |

| Average Volume | 21,589,028 |

| Forward P/E 1 Yr | -23.21 |

| Earnings Per Share(EPS) | $-3.76 |

| Market Cap | 1,997,072,691 |

Riot Blockchain: Evolution And Roadmap

Riot Blockchain came into existence in October 2017, following a name change from Bioptix, a life science technology company with a registered veterinary patent. Bioptix initially went public in January 2003.

Following the transition to Riot Blockchain, the company’s stock price experienced a significant increase, soaring from $8 per share to $40 per share within a few months. In March 2018, Riot Blockchain revealed in SEC filings that it had acquired 92.5% of Logical Brokerage Corp, a registered commission broker, without disclosing the purchase price. At that time, the company expressed interest in launching a cryptocurrency exchange and a cryptocurrency futures brokerage business.

In March 2019, Riot Blockchain submitted an S-3 form to the SEC detailing its blockchain mining operations in Oklahoma City, Oklahoma, and its plans for a cryptocurrency sales/trading service called RiotX, set to launch in 2019. The service was intended to include banking services, a trading engine, and digital wallet services provided by third parties. The S-3 filing also addressed the resale of securities previously issued by Riot Blockchain. However, the company’s Q2 2020 financial statements filed with the SEC did not include financial results or any information about the announced service or a potential “RiotX.”

Riot Platforms, Inc. Statement: The New York Times’ Politically Driven Attack On Bitcoin Mining Is Full of Distortions & Outright Falsehoods.

Read more in today’s press release: https://t.co/NBRv0f1Zd5

— Riot Platforms, Inc. (@RiotPlatforms) April 10, 2023

According to Riot Blockchain’s Q1 2019 financial report submitted to the SEC, the company continued to experience losses but at a slower rate than the previous year. During the quarter, Riot Blockchain mined 329 Bitcoins, 356 Bitcoin Cash (BCH), and 1,422 Litecoins, with some operations nearly breaking even. In a public statement, the company claimed to be “one of the biggest cryptocurrency miners.”

The Q2 2020 financial report (SEC Form Q-10) disclosed a continued net loss of nearly $5 million in the first half of 2020, which was $162,000 less than the same period in the previous year. Riot Blockchain reported mining 508 Bitcoins in the first half of the year and generated total mining revenue of $4,280,000.

Riot’s Initiative To Reduce Electric Cost

In the burgeoning blockchain mining industry, it is not uncommon for energy-intensive mining farms to relocate in search of more affordable electricity or colder regions that are better suited for server cooling, as processors generate increasing amounts of heat.

In April 2020, Riot announced plans to move some of its Antminer S17 mining machines from its Oklahoma City facility to Coinmint’s data center in Massena, NY. The move aimed to save on electricity costs due to the excessive heat in Oklahoma City, which presents challenges in cooling power-hungry servers. Coinmint claims that, at the time, its mining farm was the largest cryptocurrency mining facility in the world.

Riot Acquires Whinstone

Despite its unfavorable climate and carbon-intensive electricity, Rockdale, Texas, has managed to attract the largest Bitcoin mining farm in America due to its low-cost electricity. The facility, operated by Whinstone US, a competitor of Riot and owned by the German group Northern Bitcoin AG, has garnered significant attention.

On April 8, 2021, Riot Blockchain announced its acquisition of Whinstone through a $651 million deal, which included $80 million in publicly traded cryptocurrencies. This takeover allowed Riot to gain control of the Bitcoin mining facility, one of the largest in America.

In the fall of 2019, Whinstone partnered with Bitmain, the world’s largest producer of integrated circuits specifically designed for mining, to develop a mining farm in Rockdale, Texas. At the time, Bitmain disclosed plans to launch a 25-megawatt facility, with the potential to expand to 300 megawatts in the future.

Riot Stock Price Forecast: Price History

To get a detailed Riot share value outlook, it is essential for investors to get an idea of Riot stock’s price history to determine its future growth potential. However, it is to be noted that past performance is not an indicator of Riot’s future price points and financial projections.

From its humble beginnings as a life science technology company to its metamorphosis into a trailblazer in the crypto mining industry, Riot Blockchain has had quite the journey. In October 2017, Bioptix transformed into Riot Blockchain, marking a pivotal moment in the company’s history. The stock price began to soar, fuelled by the rising interest in cryptocurrencies and the company’s strategic shift toward blockchain technology. RIOT’s stock price skyrocketed from $8 per share to $40 per share within a few months following the name change.

In March 2018, Riot Blockchain disclosed its acquisition of 92.5% of Logical Brokerage Corp, a registered commission broker. This move, aimed at exploring opportunities in cryptocurrency exchanges and futures brokerage businesses, generated excitement among investors and analysts. However, the stock’s price remained relatively volatile during this period.

In April 2020, Riot Blockchain announced plans to relocate some of its Antminer S17 mining machines to Coinmint’s data center in Massena, NY. The decision aimed to save on electricity costs and improve server cooling efficiency. However, the stock’s price did not react much to this news as its price traded within a bearish consolidation level at $6.

In April 2021, Riot Blockchain made headlines with its $651 million acquisition of Whinstone, one of the largest Bitcoin mining farms in America. The acquisition immediately positioned Riot as a dominant player in the crypto mining industry, sending the stock price soaring. RIOT stock made a high of $77 in that year. However, its price has begun to decline since then. The stock’s price traded in a bullish region for a few months and dropped below $10 in April 2022.

Since then, RIOT stock’s price did not recover much and is currently trading in a negative region.

Riot Stock Price Forecast: Technical Analysis

Recently, Riot stock has recently experienced a strong bearish trend with no apparent signs of recovery in sight. This decline is further exacerbated by the fear of upcoming interest rate hikes, raising concerns about a potential sharp decrease in the stock’s value. However, the Riot stock has made an upward journey, pushing above critical resistance levels. A thorough technical analysis of Riot’s stock shows promising bullish indicators, suggesting that investors should proceed with a long-term plan when considering this investment.

According to TradingView, Riot shares are currently trading at $11.96, reflecting an increase of over 1% in the last 24 hours. Our technical evaluation of Riot stocks indicates that the bearish momentum is not over yet, and bears may make a comeback if the Riot stock fails to hold bullish goals. Examining the daily price chart, Riot shares have found support near the $10 level, from which the stock price may try to breach its immediate resistance level. As Riot’s price recently surpassed its EMA20 trend line, buyers may gain confidence and open long positions, pushing the stock’s price higher in the coming days before any downward movement emerges. The Balance of Power (BoP) indicator is currently trading in a bullish zone at 0.38, hinting at a 5% upward correction soon.

To thoroughly analyze the price of Riot shares, it is crucial to take into account the RSI-14 indicator. As this indicator recently experienced substantial buying pressure, it has risen above the mid-line and trades near the buying region of the 59-level, suggesting an intensity between bears and bulls after Riot stock reached a crucial level of $11. It is anticipated that Riot’s price will soon attempt to break above its 38.6% Fibonacci level to achieve its short-term bullish goals. If Riot fails to climb above this Fibonacci region, a downtrend might be imminent.

As the SMA-14 continues its upward journey near the 63-level, it trades way above the RSI line, potentially accelerating the stock’s upward correction on the price chart. If Riot shares break above the consolidation zone, it can pave the way to the crucial resistance at $13.8. A breakout above the strong resistance at $14 will drive the share price toward the upper limit of the Bollinger band at $18.7.

Conversely, if Riot fails to hold above the critical support level of $10, a sudden collapse may occur, resulting in further price declines and causing the Riot share to trade near the Bollinger band’s lower limit of $5.3. If Riot’s price cannot sustain trade above $5, it may trigger a more significant bearish downturn.

Riot Stock Price Prediction By BlockchainReporter

Riot Stock Price Prediction 2023

The year 2023 is expected to see a continued surge in the adoption of cryptocurrencies, providing a favorable environment for Riot Blockchain. Based on historical trends, the maximum price for Riot’s stock could reach $92, while the minimum price might hover around $42. The average price for the year is estimated to be around $67.

Riot Stock Price Prediction 2024

In 2024, we expect the cryptocurrency market to stabilize further, paving the way for a more significant adoption of blockchain technology. As Riot continues to expand its mining operations, the maximum stock price may hit $115, with a minimum price of $50. The average price for the year could be around $82.5.

Riot Stock Price Prediction 2025

By 2025, Riot is projected to benefit from increased demand for blockchain services, which could lead to its stock price soaring to a maximum of $135. The minimum price is expected to be around $65, with an average price of $100 for the year.

Riot Stock Price Prediction 2026

Continued growth in the blockchain industry in 2026 could push Riot’s maximum stock price to $150. The minimum price is anticipated to be around $85, with an average price of $117.5 for the year.

Riot Stock Price Prediction 2027

As the cryptocurrency market matures, Riot Blockchain’s stock price is expected to experience significant growth. In 2027, the maximum price could reach $180, with a minimum price of $100. The average price for the year is projected to be around $140.

Riot Stock Price Prediction 2028

In 2028, Riot’s stock price could climb even higher, hitting a maximum of $210 as the company solidifies its position in the market. The minimum price is estimated at $125, with an average price of $167.5 for the year.

Riot Stock Price Prediction 2029

By 2029, Riot Blockchain’s stock price is expected to continue its upward trajectory, potentially reaching a maximum of $245. The minimum price could be around $150, with an average price of $197.5 for the year.

Riot Stock Price Prediction 2030

In 2030, Riot’s stock price could achieve a maximum of $275 as the company expands its global reach and technological capabilities. The minimum price is predicted to be around $175, while the average price could be $225, and the maximum price might trade at $275.

Riot Blockchain Stock Forecast: Industry Experts

According to CNN’s Riot stock forecast, ten analysts have provided 12-month price predictions for Riot Platforms Inc. The median forecast is $12.00, while the high and low estimates are $17.00 and $6.00, respectively. This median projection indicates a slight increase of 0.33% from the current price of $11.96.

According to MarketBeat’s compilation of eight analyst ratings, RIOT’s average stock price target for the next 12 months is $44.88, indicating a significant potential increase from the current share price. The range of RIOT stock predictions is between $30 and $50, with all eight analysts recommending a ‘buy’ rating for the stock.

Riot Blockchain: Financial Outlook

Riot Blockchain, a Bitcoin mining company headquartered in Colorado, announced a total revenue of approximately $260 million for 2022, reflecting a 22% growth compared to the previous year. The company also achieved an all-time high hash rate capacity of 9.7 EH/s and mined 5,554 BTC. These accomplishments are particularly notable given the bear market that persisted for most of the year and the production decrease that occurred during the summer due to a heat wave.

In 2022, Riot generated 46% more Bitcoin than the previous year. Nonetheless, the downturn in the cryptocurrency market impacted its BTC mining earnings, resulting in a revenue of $156 million, compared to the previous year’s $184 million.

Riot’s CEO, Jason Les, lauded the company’s performance in 2022, citing its remarkable accomplishments, such as achieving an all-time high in hash rate capacity of 9.7 EH/s (up from 3.1 EH/s as of December 31, 2021), expanding its operations at the Rockdale Facility, and maintaining a robust financial position.

Riot Achieves New All-Time High Hash Rate Capacity in March 2023.

“Riot is proud to announce another strong month of production, mining 695 #Bitcoin in the month of March. This strong performance is a direct result of the hard work our team members have put in over the past two…

— Riot Platforms, Inc. (@RiotPlatforms) April 5, 2023

Moreover, in March 2023, Riot reached a new ATH in hash rate capacity. Riot’s self-mining operations produced 695 BTC, which was a 36% increase compared to the 511 BTC produced in March 2022. At the end of March 2023, Riot held 7,072 BTC, all produced by their own mining operations. Riot sold 675 BTC, resulting in net proceeds of approximately $16.7 million. As of March 31, 2023, Riot had a fleet of 94,176 miners deployed, capable of a hash rate capacity of 10.5 exahash per second (“EH/s”). This excludes 17,040 miners that are currently offline due to damage caused by severe winter weather in late December in Texas.

Conclusion

Riot Blockchain has emerged as a trailblazer in the cryptocurrency and blockchain sector, demonstrating remarkable adaptability and resilience in its pursuit of a comprehensive approach to industry dominance. As one of the few publicly traded companies to concentrate solely on this rapidly evolving market, Riot Blockchain’s strategic investments across the mining, exchange, accounting, and futures segments have positioned it as a force to be reckoned with in the world of digital finance.

As the company continues to diversify its portfolio and capitalize on synergies between its various assets, Riot Blockchain is poised to not only ride the wave of industry momentum but to become a powerful catalyst for innovation and growth in the cryptocurrency and blockchain landscape. The future is bright for this pioneering company, and investors and enthusiasts alike should keep a watchful eye on the potential ripple effects of Riot Blockchain’s bold and ambitious strategies.

FAQ

Riot Blockchain is a leading North American-based Bitcoin mining company. It was founded in 2000 as a biotechnology company, but pivoted to cryptocurrency mining in 2017. The company now operates state-of-the-art mining facilities and has a reputation as a green mining pioneer due to its commitment to renewable energy sources.

While the RIOT stock has experienced a decline in recent months, technical analysis and predictions suggest a potential for recovery in the coming years. Forecasts for 2023-2030 indicate a gradual increase in stock price, with a potential maximum price of $275 by 2030.

According to CNN, ten analysts have provided 12-month price predictions for RIOT stock, with a median forecast of $12.00, while MarketBeat’s compilation of eight analyst ratings suggests an average stock price target of $44.88 for the next 12 months.

Since its transition to cryptocurrency mining in 2017, Riot Blockchain’s stock price has experienced significant fluctuations, with highs of $40 per share following its name change, and later reaching $77 after acquiring Whinstone in 2021. More recently, the stock’s price has declined, trading below $10 in April 2022.

In 2022, Riot Blockchain generated a total revenue of approximately $260 million, reflecting a 22% growth compared to the previous year. The company also achieved an all-time high hash rate capacity of 9.7 EH/s and mined 5,554 BTC. The company’s CEO, Jason Les, has highlighted the company’s robust financial position and ongoing expansion efforts.

Yes, Riot Blockchain was among several companies subpoenaed by the U.S. Securities and Exchange Commission (SEC) due to concerns regarding the inclusion of “blockchain” in their names without a clear connection to the industry. However, on January 30, 2020, Riot Blockchain announced that the SEC’s Division of Enforcement had concluded its investigation and recommended no enforcement action against the company.

READ MORE:

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

Wrapped LUNA Classic (WLUNC) Price Prediction

Bitcoin Para Real: Navigating the Brazilian Cryptocurrency Market

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?

Bitgert Price Prediction: Is Bitgert a Good Investment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

Nio Stock Price Prediction 2030: Will There Be a Bullish Reversal for Nio Stock?

Controlling Bitcoin Mining Hashrate: Report on Core Scientific 545M & Riot Blockchain 215M Earning

Riot Blockchain Inc. Reveals Ongoing SEC Investigation Amid Mounting Losses