Bitcoin (BTC) is officially boring: The price was flat on Thursday at just above $19,000, and data shows that the largest cryptocurrency by market value’s 30-day volatility is at its lowest in almost two years.

Today’s drama came from Axie Infinity, the “play-to-earn” gaming platform that has mostly been a disappointment this year. The platform’s once-hot AXS tokens fell 8%, one of day’s worst performers among digital assets, after a CoinDesk report that millions of the tokens are due to be unlocked – meaning that early investors who have been restricted from selling because of vesting periods might now choose to dump the token.

The CoinDesk Market Index (CMI), a broad-based market index that measures the performance of a basket of cryptocurrencies, was relatively flat, down 0.6% over the past 24 hours.

In traditional markets, U.S. stocks rallied after better-than-expected third-quarter corporate earnings reports.

Investors across the board remain cautious, with the Federal Reserve’s next monetary-policy meeting less than two weeks away and steep interest-rate hikes expected.

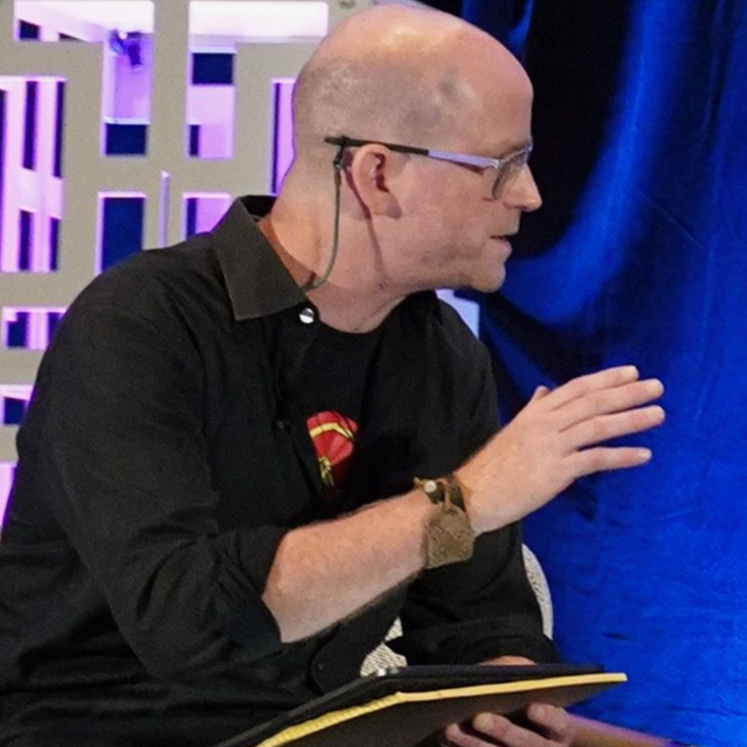

“Bitcoin has been stuck in a consolidation pattern,” Edward Moya, senior markets analyst at Oanda, wrote in a daily update. “Seems like it will continue until investors can confidently believe the Fed will stop hiking.”

● CoinDesk Market Index (CMI): 925.80 −1.3%

● Bitcoin (BTC): $19,043 −0.7%

● Ether (ETH): $1,284 −0.7%

● S&P 500 daily close: 3,665.78 −0.8%

● Gold: $1,632 per troy ounce +0.3%

● Ten-year Treasury yield daily close: 4.23% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

A bitcoin market indicator is signaling the asset is undervalued

BTC MVRV Z-Score (Glassnode)

Bitcoin is as undervalued as it has been since 2020, based on a key indicator that relies on data extracted from the blockchain.

The “MVRV Z-Score” is an analytical tool used to assess whether bitcoin (BTC) is looking cheap or expensive on a relative historical basis.

The metric measures the difference between an asset’s market capitalization – the number of tokens outstanding times the spot price – and its “realized cap” – the number of tokens times the price at which the bitcoin last moved over the blockchain.

That difference is then divided by the standard deviation of the asset’s market cap. Similar to other technical indicators, it theoretically highlights areas where an asset is overvalued or undervalued.

-

Crypto Gaming Token AXS Under Pressure as $215M Unlock Looms for Axie: Some 10 million of Axie’s AXS tokens owned by insiders and early investors will be unlocked soon, creating selling pressure. AXS price has dropped following prior unlocking. Read more here.

-

State Securities Regulators Move to Shut Down NFT Scam Tied to Metaverse Casino: Officials from Alabama, Kentucky and Texas filed cease-and-desist orders against Slotie NFT, alleging the illegal and fraudulent sales of non-fungible tokens (NFT). The action comes as states are increasingly joining forces to tackle crypto crimes. Read more here.

-

Listen 🎧: Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and a look at the threat CBDCs may pose to the state of crypto.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.