mediaphotos/iStock via Getty Images

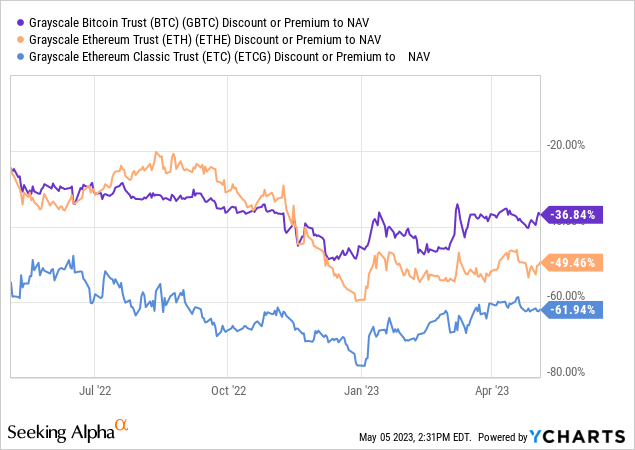

I’ve covered Grayscale’s Ethereum Classic Trust (ETCG) a couple times in the past and most recently in early March. My general feel on ETCG is that until there is meaningful activity growth on the Ethereum Classic (ETC-USD) blockchain, it’s probably best to avoid playing the enormous NAV arbitrage that is evident by the current 62% discount to the fund’s underlying ETC holdings. I won’t beat a dead horse in this article, but I will explore some possible outcomes based on news that Digital Currency Group CEO Barry Silbert recently sold a portion of his ETCG holdings.

Related Party Sales

In a recent filing with the SEC, Barry Silbert disclosed the selling of 119,320 shares of ETCG. At the time of those sales, the market value of the distribution was a little over $755k. This is newsworthy because Silbert is the CEO of Grayscale parent company Digital Currency Group. Silbert is also a Director for the Ethereum Classic Trust and a 10% holder in the trust shares. The liquidated ETCG shares represent a little less than 1% of the 13,993,800 shares outstanding.

In addition to these sales, Grayscale also released its latest 10-Q for the trust Friday morning. The company disclosed a reduction in related party holdings from 3,258,770 shares at the end of December down to 3,122,214 shares at the end of March. Because that period pre-dates the disclosed Silbert distribution, I believe we can reasonably assume that related party holdings is actually now down to 3,002,894. That’s a year to date reduction in holdings of almost 8%.

Interestingly, ETCG isn’t actually the only Grayscale fund that is experiencing related party sales. Grayscale released updated 10-Qs for all eight of the company’s single asset trusts Friday morning. It’s actually Grayscale’s Ethereum Trust (OTCQX:ETHE) that has seen the largest reduction in related party holdings going back to the previous filings:

| Grayscale Trusts | Last reporting period | Current reporting period | Change |

| Bitcoin (OTC:GBTC) | 36,065,470 | 36,066,527 | 0.00% |

| ETHE | 11,811,797 | 8,728,797 | -26.10% |

| ETCG | 3,258,770 | 3,122,214 | -4.19% |

| Horizen (OTCQX:HZEN) | 3,643,924 | 3,614,804 | -0.80% |

| Litecoin (OTCQX:LTCN) | 1,296,956 | 1,126,498 | -13.14% |

| Stellar (OTCQX:GXLM) | 118,192 | 118,589 | 0.34% |

| Zcash (OTCQX:ZCSH) | 875,407 | 875,407 | 0.00% |

| Bitcoin Cash (OTCQX:BCHG) | 1,786,273 | 1,443,441 | -19.19% |

Source: Grayscale

I think there are a few ways to look at this. With the exception of the Bitcoin (BTC-USD) trust, the majority of the remaining funds that were largely untouched are much smaller and far more illiquid:

| Grayscale Trusts | AUM | Related Party Owns |

Ownership Change |

| GBTC | $18,141,053,264 | 5.21% | 0.00% |

| ETHE | $5,652,509,179 | 2.81% | -26.10% |

| ETCG | $225,779,407 | 22.31% | -4.19% |

| LTCN | $132,775,270 | 6.55% | -13.14% |

| BCHG | $35,797,465 | 4.15% | -19.19% |

| ZCSH | $11,926,286 | 23.17% | 0.00% |

| GXLM | $6,889,168 | 14.38% | 0.34% |

| HZEN | $5,805,837 | 52.86% | -0.80% |

Source: Grayscale

Furthermore, related parties own a much smaller proportion of the shares outstanding in the funds that were sold the most, possibly indicating that those funds have a more robust bid in the open market. Again, GBTC was an outlier here and I imagine it’s because of the lawsuit with the SEC. Pertaining to the ETCG shares, related parties own such a large percentage of the shares outstanding that it’s likely very difficult to distribute a larger percentage of those holdings without completely nuking the NAV discount further.

While most of those funds trade between 25% and 50% discounts, ETCG is bringing up the rear at 62%. My view is that discount has more to do with the ownership concentration than the Ethereum Classic network itself. But even considering that, the activity level on-chain doesn’t justify longing ETCG for the arb.

Ethereum Classic Still Lacks Activity Growth

I’ll reiterate that I have no interest in beating a dead horse in this article. So to quickly provide some context on the level of activity happening on the Ethereum Classic blockchain, nothing has meaningfully changed since my last article in March:

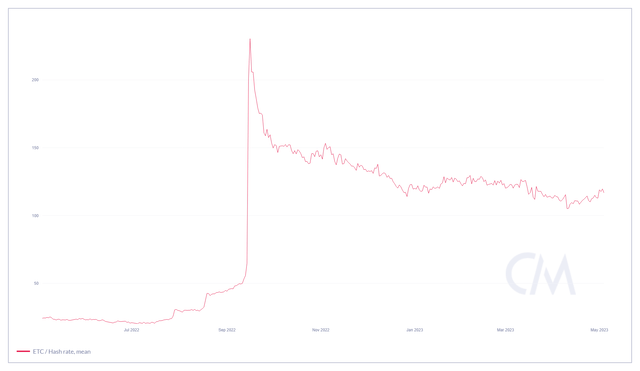

ETC Mean Hash Rate (CoinMetrics)

Mean hash rate is still at higher levels from August but down about 50% of the post “Merge” high.

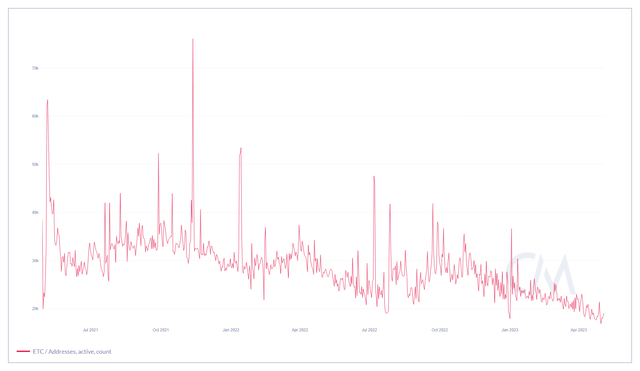

ETC DAUs (CoinMetrics)

Additionally, daily active addresses just made a new two year low of 16.9k on April 29th.

Summary

There are multiple ways to look at ETCG. On one hand, it’s a simple bet on the network utility and adoption of Ethereum Classic. I don’t personally view that as a good bet today. The other way to look at ETCG is as an arbitrage on liquidation value. Meaning, if Grayscale ultimately moves to liquidate the fund entirely and distribute the proceeds to ETCG holders, ETCG gets very attractive as the cash return on that distribution would be much higher than the market value of the shares presently. Of course, that’s provided there is market demand for Grayscale’s ETC sales.

Likewise, if Grayscale wins its SEC case and can begin transitioning additional funds to ETFs, a redemption mechanism should be able to close the NAV discount in these funds as well. But if that were a likely possibility, it is doubtful in my view that Barry Silbert and other related parties would be selling shares at a 62% discount unless they are desperate for cash – which is certainly a possibility. As I said in my last article, I can empathize with the “code is law” mentality of ETC supporters. But without an increase in organic demand for ETC, I don’t think the story is there for ETCG arb plays. Given how much ETCG is owned by related parties and the apparent motivation from those parties to sell, I’d probably cut out of ETCG if I was holding it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I’ll help you find the ones that have staying power. Service features include:

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I’ll help you find the ones that have staying power. Service features include:

- My Top Token Ideas

- Trade Alerts

- Portfolio Updates

- A Weekly Newsletter

- Full Podcast Archive

- Live Chat

Crypto Winter can be cold and brutal. But there is value in public blockchain and distributed ledger technology. Sign up today and position your portfolio for the future!