With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

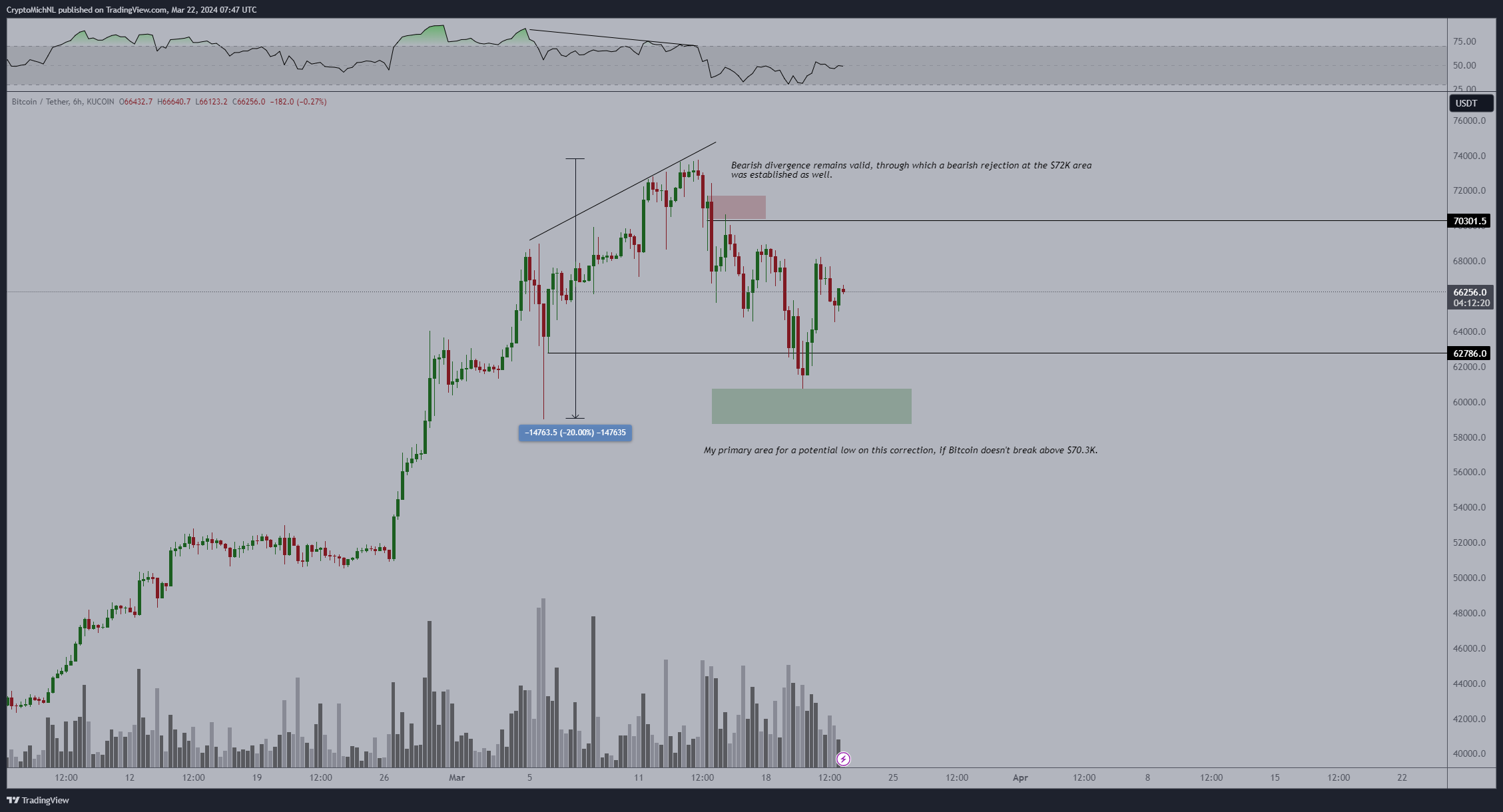

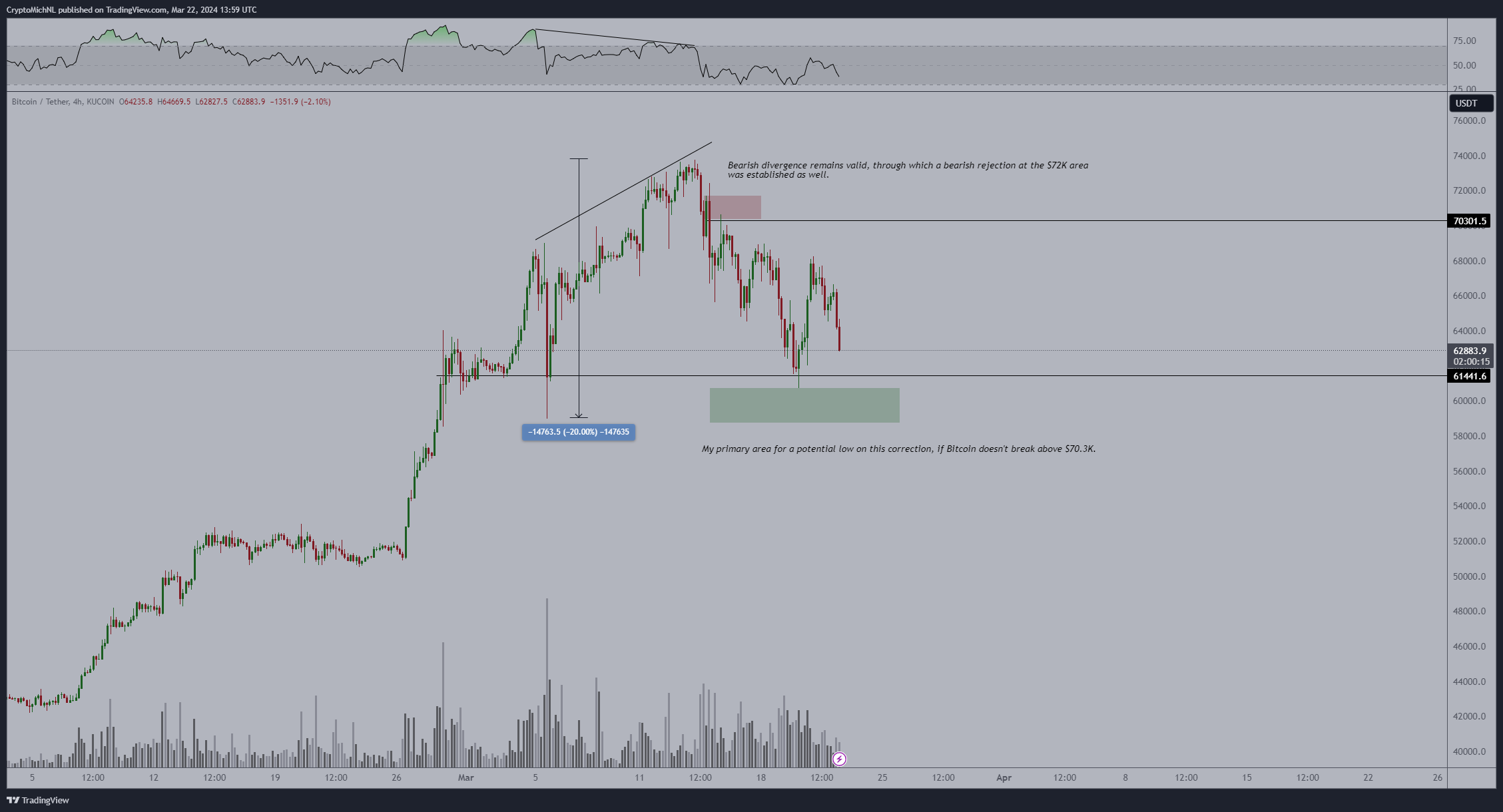

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

BTC is worth $63,873 at time of writing, down 4% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3