Bitcoin miners have been raking in historically high amounts of transaction fees recently, but on-chain data shows this cohort still isn’t selling.

Bitcoin Miners Haven’t Transferred Much Volume Towards Exchanges Recently

The transaction fees on the Bitcoin network have shot up recently because of the increased traffic caused by the Ordinals, a protocol that allows data to be inscribed into the Bitcoin blockchain with transactions.

Generally, the transaction fees remain low during times when there is little activity on the blockchain as investors have no need to pay higher fees to get transfers through quickly.

However, when the network is congested, however, waiting times in the mempool can stretch longer, so the senders who want their transfers to be processed faster attach a high amount of fees with them. This provides miners with an incentive to handle such transfers first.

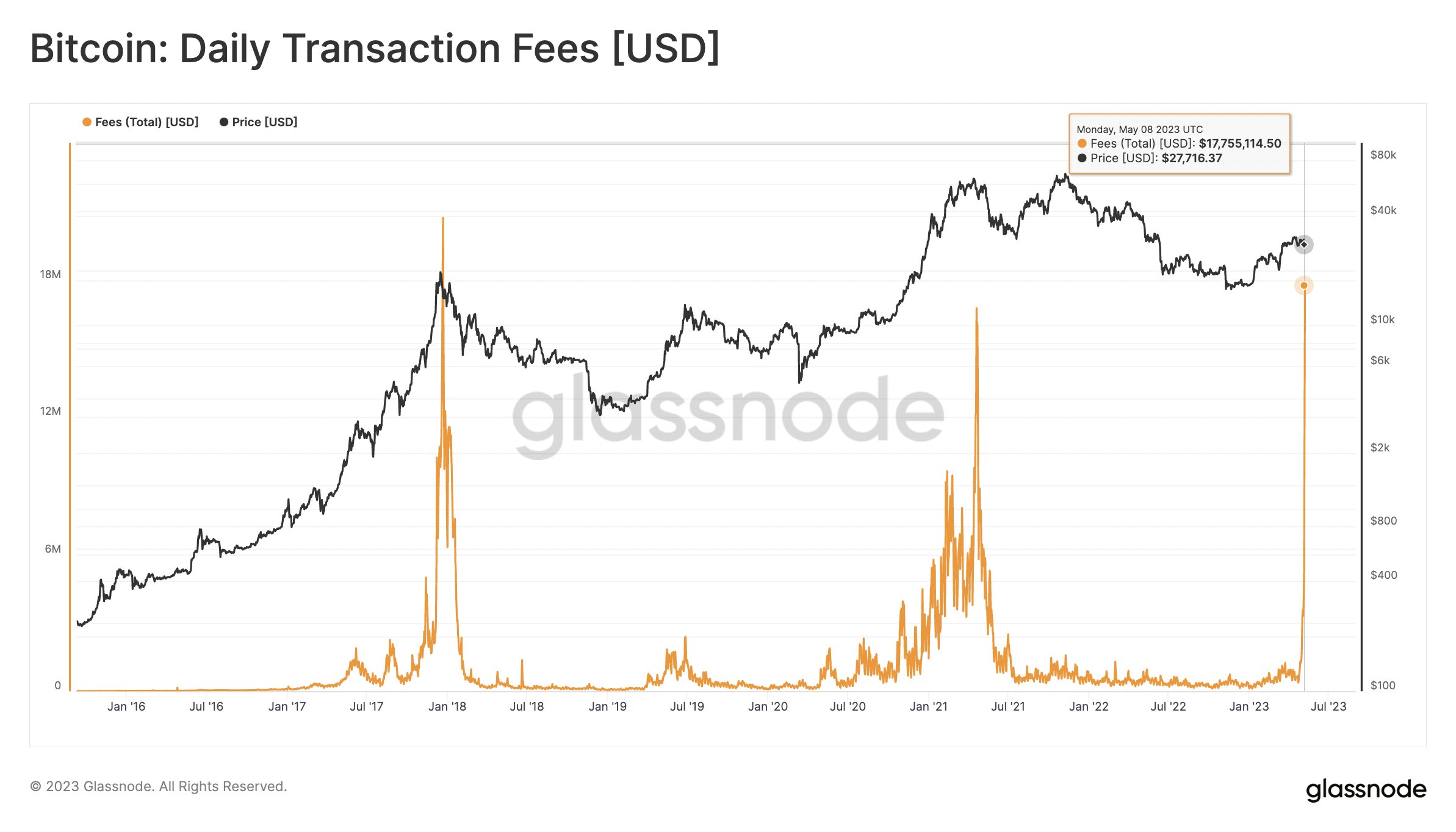

There have been some extraordinary congestion on the blockchain recently, so it’s not a surprise that the transaction fees have blown up to some pretty high levels, as the below chart from Rafael Schultze-Kraft, the co-founder of Glassnode, displays.

The value of the metric seems to have been quite high in recent days | Source: Rafael Schultze-Kraft on Twitter

As displayed in the above graph, the Bitcoin transaction fees have shot up to $17.7 million recently, which is an extremely high amount even when compared to the height of the past bull runs.

The main reason behind this surge has been the spike in the usage of Ordinals. In particular, the rise in the popularity of the BRC-20 tokens, fungible tokens that have been created using the Ordinals protocol, has been at the center of this activity. Many meme coins have come up that are based on this protocol, including the explosively popular Pepe Coin (PEPE).

From the chart, it’s visible that only the 2017 bull run top saw the total transaction fees on the blockchain hitting higher values. The first half of the 2021 bull run top saw similar, but still slightly lower levels to the current spike.

Naturally, the miners are enjoying the burst of activity being seen on the network right now, as transaction fees make up for one of the two main revenue streams for these chain validators (the other being the block rewards).

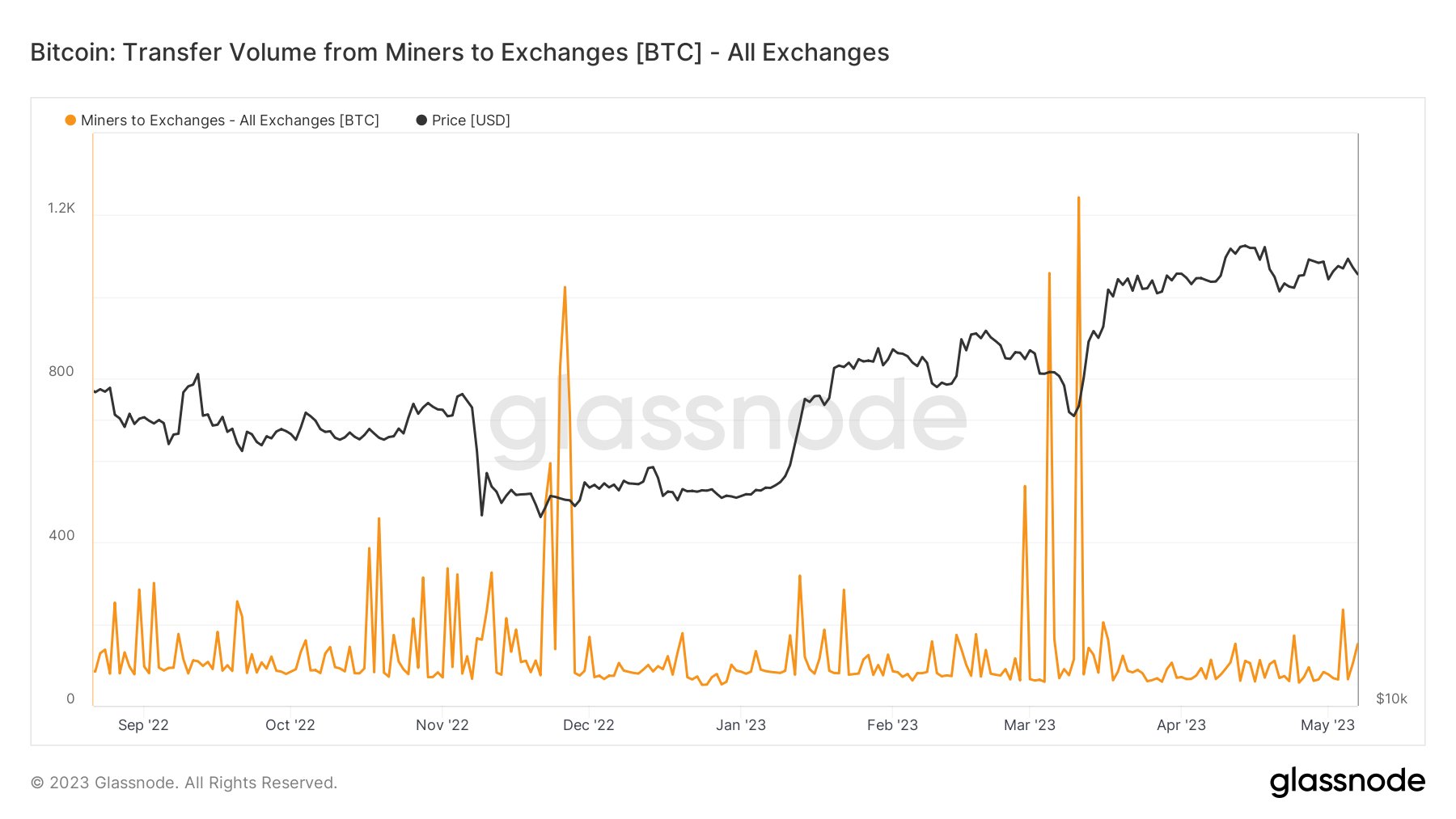

In such a period of booming business, there may be concerns about whether the miners would sell some of their reserves here to realize these high revenues. But so far, the transaction volume from the miners going towards centralized exchanges has remained low, according to the chart shared by Mitchell from Blockware Solutions.

Looks like the value of the metric has stayed low recently | Source: MitchellHODL on Twitter

Usually, these investors transfer their coins to exchanges whenever they want to participate in the distribution of the asset. Since they haven’t been sending any suspicious amounts to these platforms recently, it’s possible that they don’t intend to sell their Bitcoin yet.

This can be a positive sign for the market, as it might mean that this BTC cohort has decided to accumulate the extra revenue that they have been receiving recently.

BTC Price

At the time of writing, Bitcoin is trading around $27,600, down 4% in the last week.

BTC has observed some decline in the last few days | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com