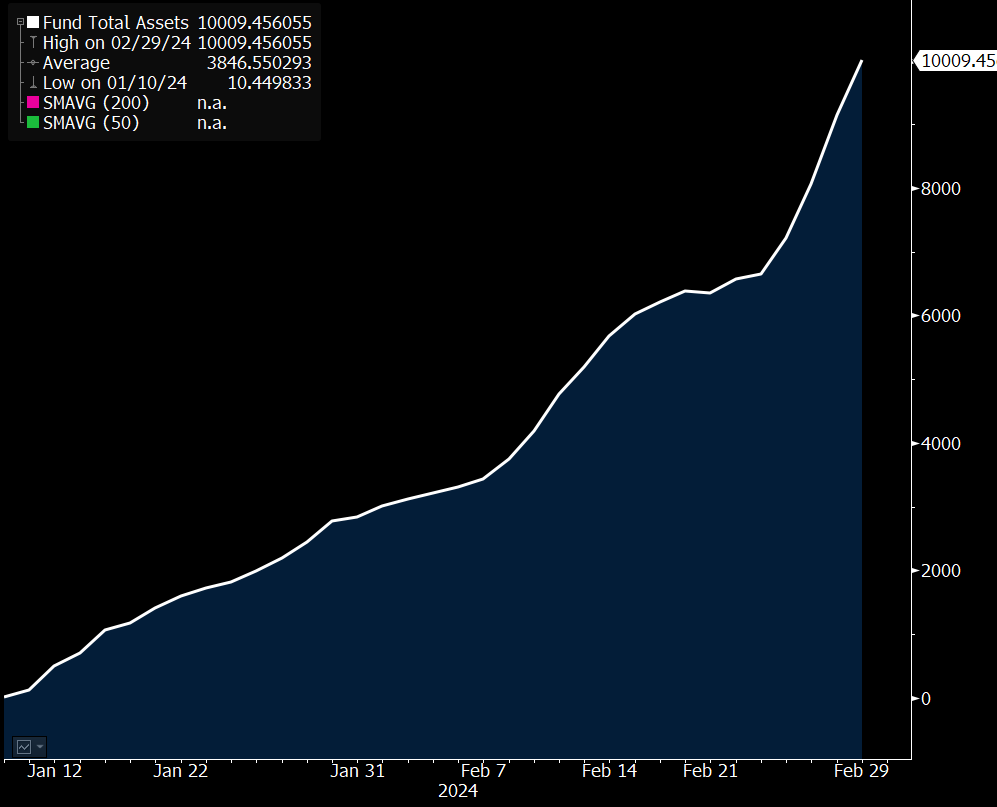

BlackRock’s new spot Bitcoin (BTC) exchange-traded fund (ETF) has already crossed $10 billion in assets under management (AUM), according to Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence.

Balchunas notes the asset management giant’s iShares Bitcoin Trust (IBIT) became one of only 52 ETFs out of 3,400 to cross that $10 billion mark.

The Bloomberg analyst says crossing the first $10 billion mark is tough for ETFs because so much of the initial AUM has to come from flows, but adding $10 billion after an ETF has already surpassed that first mark is easier because market appreciation becomes a bigger variable.

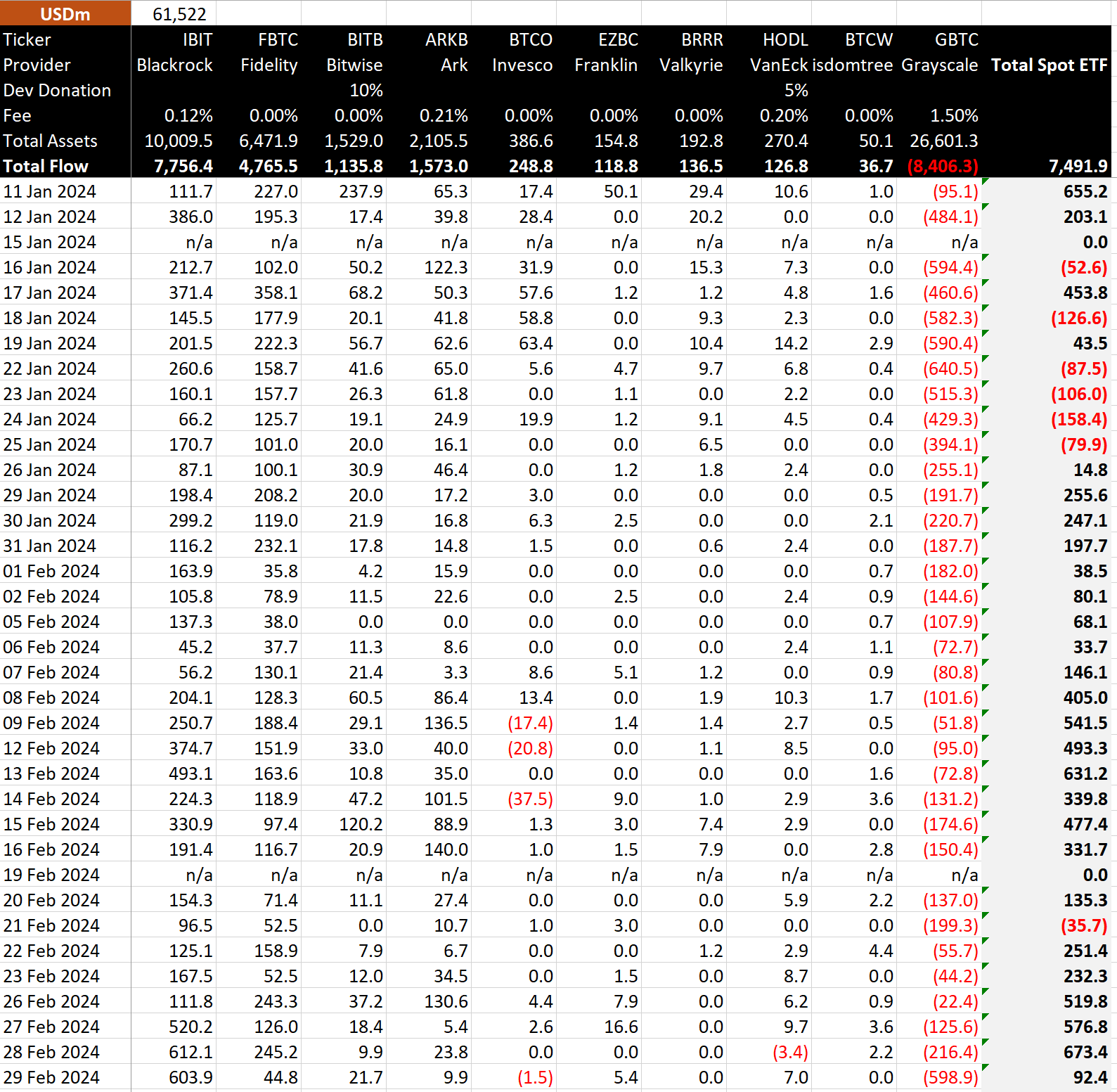

The 10 newly approved spot Bitcoin ETFs witnessed $92 million of positive flows on Thursday, according to BitMEX Research. IBIT itself saw nearly $604 million worth of positive flows alone, though that was largely counteracted by Grayscale’s GBTC, which witnessed nearly $599 million in negative flows.

Of the 10 new ETFs, Grayscale’s is the only one that isn’t an entirely new product: After the U.S. Securities and Exchange Commission (SEC) issued a flurry of BTC ETF approvals in January, the crypto-focused asset management giant converted its existing flagship product, the Grayscale Bitcoin Trust (GBTC), into an exchange-traded fund listed on the exchange NYSE Arca.

Bitcoin is trading at $62,470 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney