Legal troubles faced by Binance, the largest crypto exchange in the world, have allowed other exchanges to grow their market share, new data reports.

Following Binance’s $4 billion settlement with the US government and its former CEO’s admission of violating anti-money laundering (AML) laws, Coinbase and Bybit have gained ground in the crypto trading industry, analytics firm Kaiko reveals.

Kaiko says news of the Binance settlement added “fuel to the fire” of Coinbase’s already strong November.

“Coinbase was already in the midst of a strong month when the news broke, and the news seemingly only added fuel to the fire, propelling the stock to a 75% gain in a single month. The prevailing narrative is that the bear market is thawing, and Coinbase will be a major beneficiary of this change in conditions.”

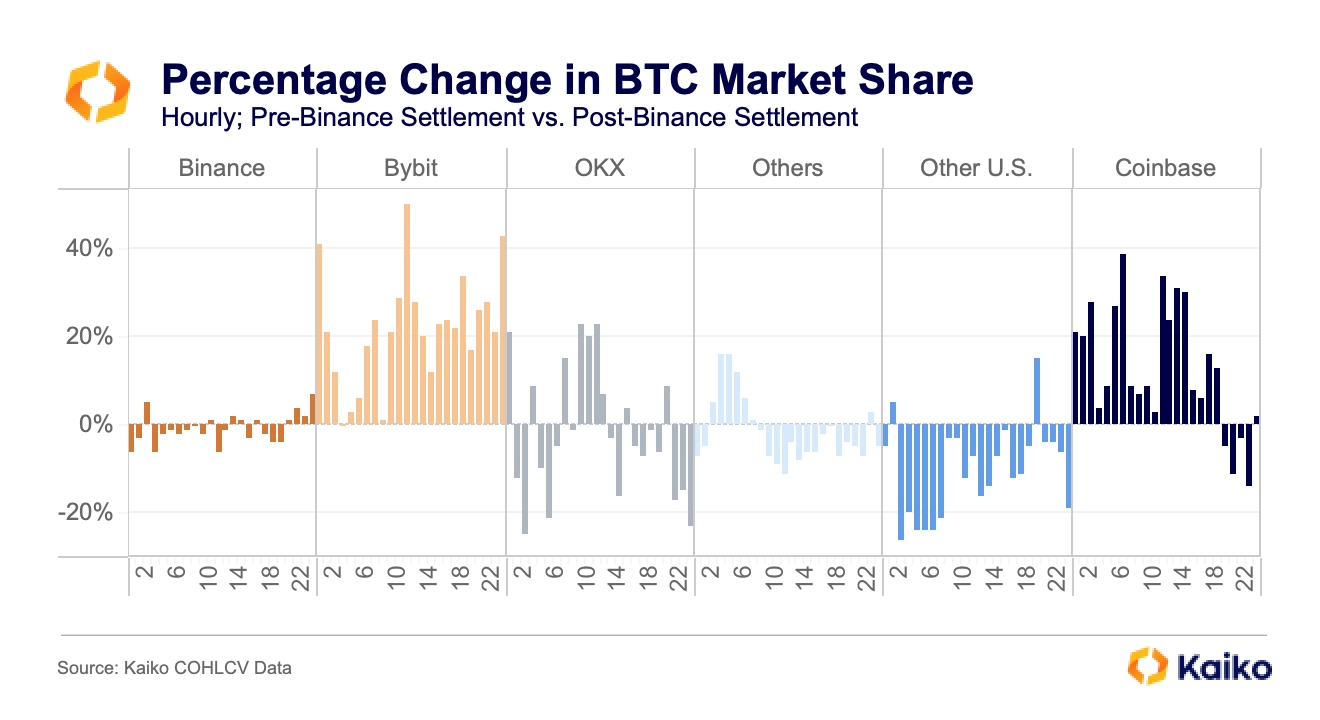

Kaiko says that Binance has ceded some market share to Coinbase during non-US trading hours and to Bybit across the board.

While the charges against Binance have largely been perceived as negative for the company, Kaiko says there’s an argument to be made that Binance has now cleared up any uncertainty directed at the exchange and could allow for clearer skies ahead.

“It’s too early to make sweeping predictions, but early trends look far from dire for Binance, while also promising for Coinbase and Bybit. This competition developed an interesting wrinkle this week in the form of an email from Coinbase to customers, which informed them that Coinbase received a subpoena from the CFTC (Commodity Futures Trading Commission) related to Bybit.

While the most popular theory is that Binance will lose share to other exchanges, it’s also possible that the compliance monitor and improved AML/KYC (know-your-customer) procedures will increase trust in the exchange, helping to maintain its share. While it could be argued that centralized exchanges are perfect substitutes, the turbulence of the past couple of years has shown that there is some stickiness to liquidity and volumes; people tend to want to keep using the exchanges that they’re already using.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney