A new report from CryptoCompare finds that top-tier digital asset exchanges such as Coinbase, FTX, Gemini and Binance have continued to increase their market share over the last six months.

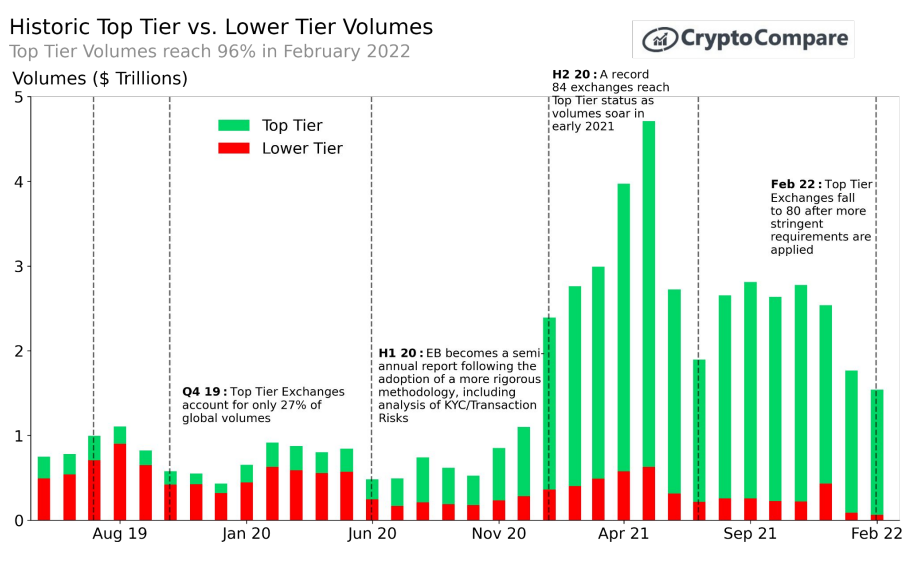

In the latest Exchange Benchmark report, CryptoCompare finds that top-tier exchanges have gained a further seven percent market share since August 2021.

“Top-Tier exchanges have increased their market share from 89% in Aug 2021 (based on Aug 2021 rankings) to 96% in February 2022 (based on the latest Feb 2022 rankings) as both retail and professional traders move to lower risk exchanges.

When taking an average over the last six months, Top-Tier exchanges account for 88% of digital asset volumes.”

According to the report, top-tier exchanges have undergone massive market share consolidation in the last two years. Since the first Benchmark report was released in 2019, 54 mid-to-low tier exchanges have shut down, unable to compete with growing top-tier trading volumes.

The report also points out how vital exchanges are to the health of the overall crypto industry and its adoption. However, the report mentions the growing tendency of traders to move assets to self-custody, which could affect crypto exchange business models as the industry grows.

“Lastly, there is a wide internal movement within crypto for users to withdraw their crypto off exchanges in preference for self-custody. The mantra of ‘not your keys, not your coins’ is growing stronger amid the political pressure received by exchanges, a movement that could hinder the business model of exchanges. This is also a key trend to consider going forward.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Relight Motion