Popular crypto analyst Michaël van de Poppe is laying out what needs to happen for Bitcoin (BTC) and the rest of the crypto market to reverse course.

In a new video update, Van de Poppe tells his 165,000 YouTube subscribers that crypto traders should keep an eye on what the US dollar is doing, as well as how the Euro is faring against the dollar.

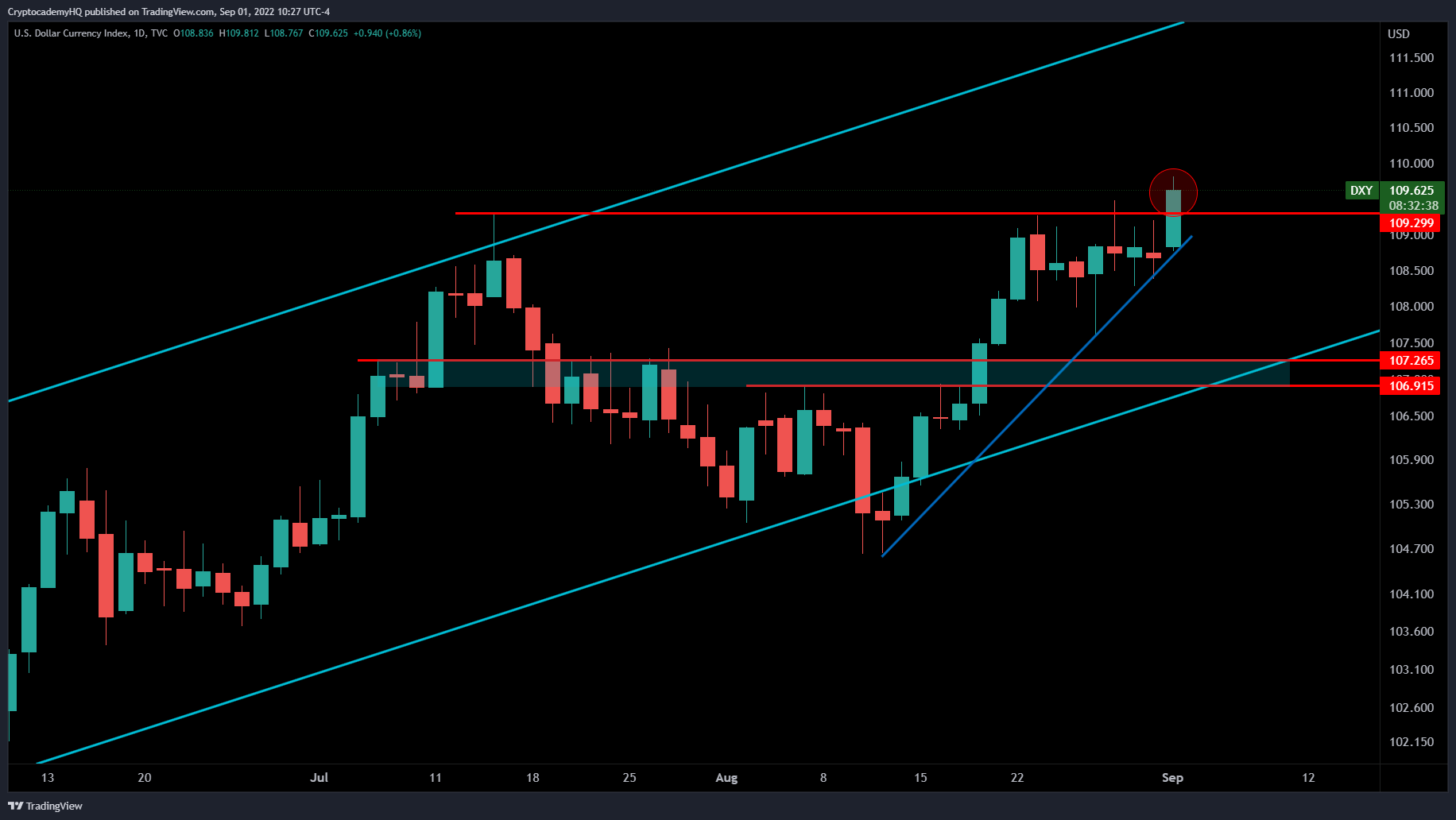

The DXY index is looking at a potential reversal soon as the monthly is getting into territories with the areas we’ve not seen since the peak in February 2015, which was ultimately the bottom of the bear market for Bitcoin. The weekly is looking at a potential reversal but it’s all dependent on the coming weeks and whether or not the DXY drops beneath 108.6 points.

In the end, Euro/USD has to reverse too and reclaim 1.01 as that could be a trigger for other currencies, including Bitcoin.”

The U.S. Dollar Index (DXY) sits at 109.57 at time of writing. The Euro is currently worth $0.9959 while the leading digital asset is trading for $20,064 at time of writing.

Van de Poppe isn’t the only crypto analyst to note the importance of the DXY to crypto’s future price moves.

Popular trader Justin Bennett tells his 107,300 Twitter followers that the dollar needs to “cool off” in order for crypto to rally.

“The argument against a rally for risk assets is the DXY, which is breaking above 109.30 today.

Need the dollar to cool off for crypto to rally.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Fortis Design/Sensvector