Data shows that Ethereum billionaire-sized wallets now control almost one-third of the entire supply, the highest level since 2016.

Ethereum Addresses With At Least 1 Million ETH Now Hold 32.3% Of Supply

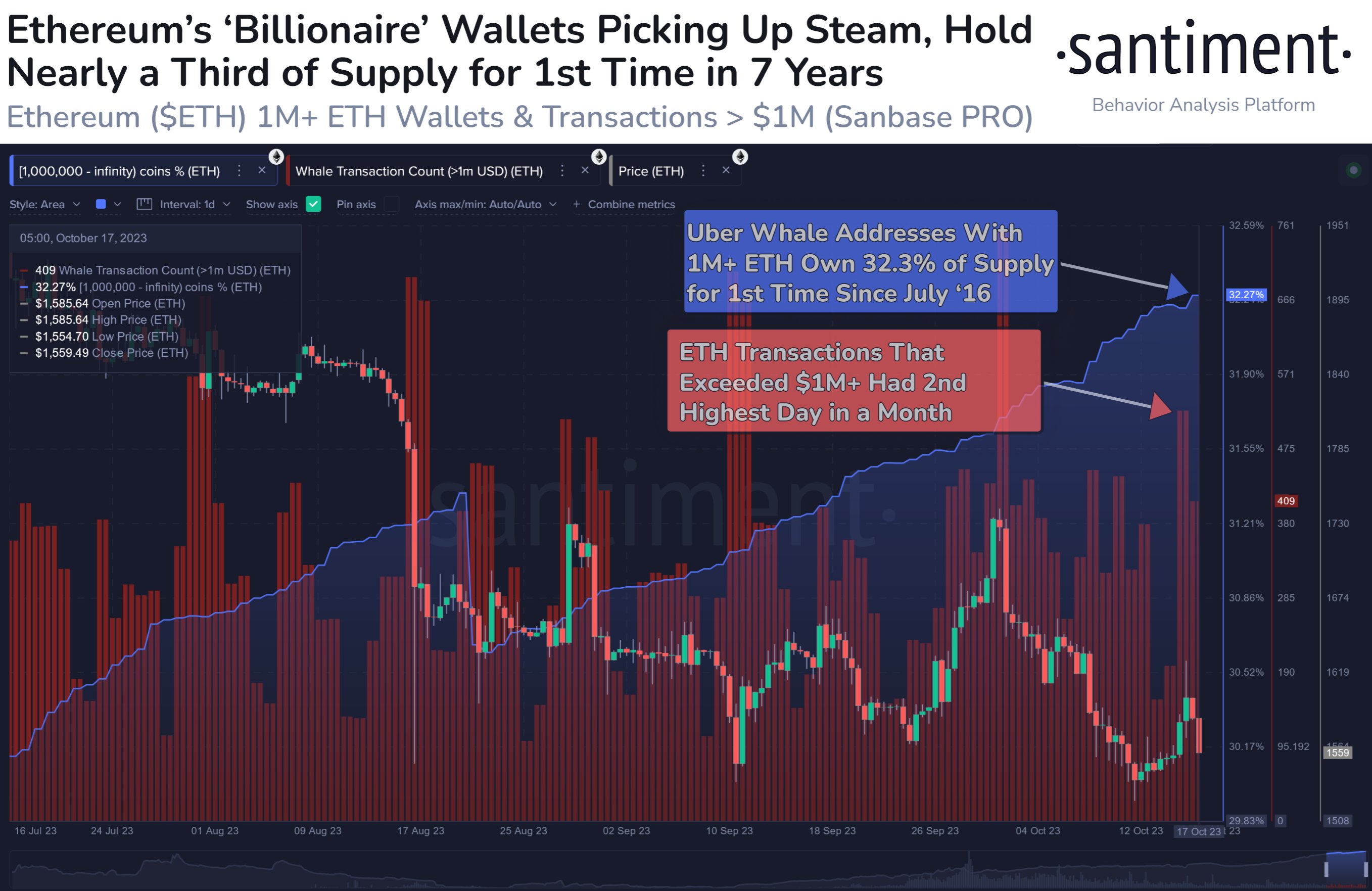

According to data from the on-chain analytics firm Santiment, the Ethereum whales with more than 1 million ETH have grown their holdings recently. The relevant indicator here is the “Supply Distribution,” which keeps track of the percentage of the Ethereum supply that each investor group is holding currently.

The holders or addresses are divided into these groups based on the number of coins that they are carrying in their balances. The 100-1,000 coins cohort, for instance, includes all investors who own at least 100 and at most 1,000 ETH.

In the context of the current discussion, the Ethereum investors with 1 million or more ETH are of interest. At the current exchange rate, this threshold amount is worth just under $1.6 billion.

As such, this group includes the largest of the whales on the network. Given the sheer size of their holdings, these humongous entities would also naturally be the most influential in the market.

Here is a chart that shows how the supply held by these Ethereum billionaires has changed during the past few months:

The value of the metric seems to have been going up in recent weeks | Source: Santiment on X

As displayed in the above graph, the Ethereum wallets with at least 1 million ETH now control a combined 32.3% of the total circulating supply of the cryptocurrency.

This is the largest part of the supply that these mega whales have owned since July 2016. While on one hand, it’s a positive sign that the largest of the investors are currently accumulating the asset; on the other hand, this does raise concerns about the centralization of the asset.

Ideally, a cryptocurrency would be decentralized among its users, with the largest hands not controlling too much of a significant part of the total supply. This is especially relevant in the case of Ethereum, which is a coin that makes use of a consensus mechanism based on “Proof-of-Stake” (PoS).

In a PoS system, validators lock their coins into the staking contract and get a chance to handle transactions. The larger their stake, the higher the probability of them being selected. In theory, a single entity with 51% of the staked supply could gain control of the entire network.

Obviously, these billionaire whales don’t control supply close to this amount yet, but the current centralization level of the network could still nonetheless be something worth paying attention to.

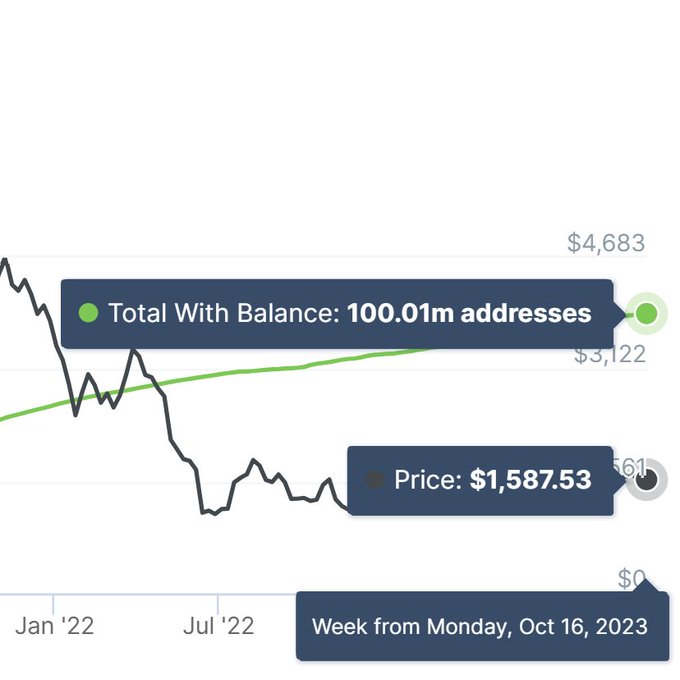

In some more uplifting news, the total number of Ethereum wallets carrying some balance has crossed the 100 million mark, a new milestone for the adoption of the asset, as data from the market intelligence platform IntoTheBlock shows.

The adoption of the asset continues to take hold | Source: IntoTheBlock on X

ETH Price

Ethereum is currently trading around the $1,580 mark after having made some recovery from its low of $1,550 yesterday.

ETH has struggled to gain upwards momentum recently | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.net, IntoTheBlock.com