A popular crypto analyst says Ethereum (ETH) challenger Cardano (ADA) may be approaching a long-awaited breakout moment.

Ali Martinez tells his 31,100 followers on the social media platform X that ADA could move above the upper bound of an enduring consolidation range as early as December.

“Cardano’s current consolidation trend eerily mirrors the 2018-2020 phase! If history repeats, ADA could stay in this consolidation phase until July 2024.

Barring unforeseen events like the COVID-19 crash, ADA could break out as soon as December!”

Looking at his chart, the trader is looking for ADA to cross the $0.50 mark. If that happens before the end of the year, he believes it would likely surpass the $6 level by the end of 2024.

ADA is trading for $0.24 at time of writing.

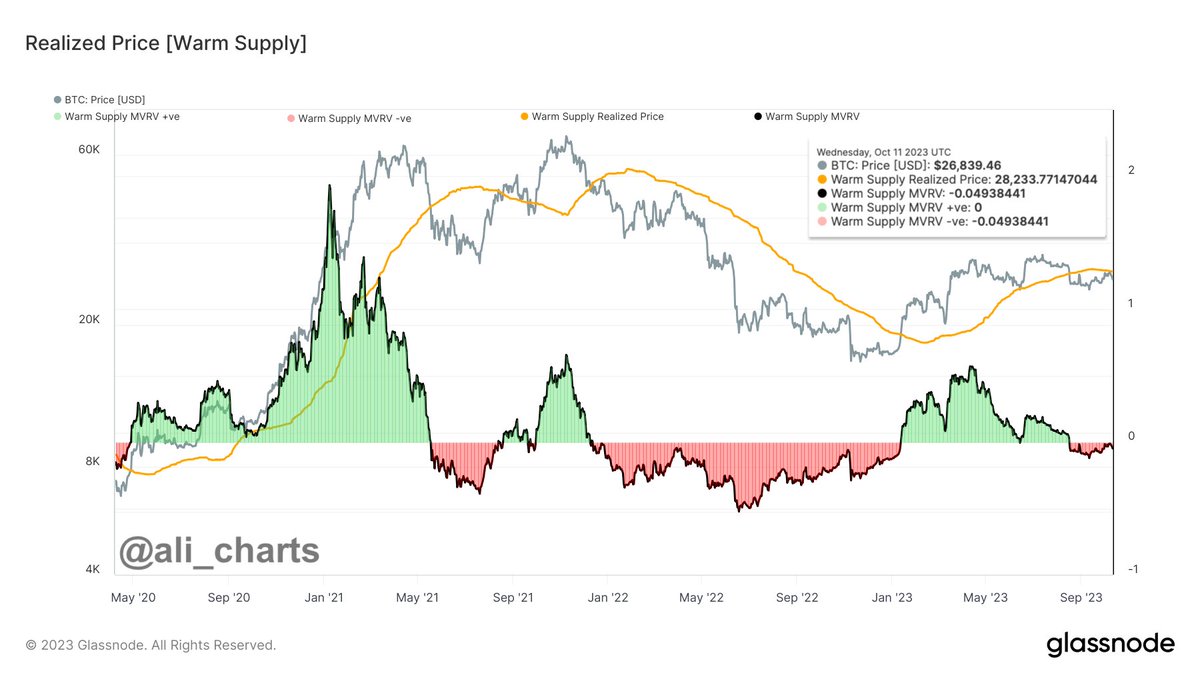

The trader is also weighing in on Bitcoin (BTC). He says the crypto king needs to convincingly close above $28,233 to ignite a bull cycle. He bases the prediction on the Warm Supply Realized Price indicator, which comprises the less active component of the short-term holder supply, right through to the start of the long-term holder cohort.

“Bitcoin Warm Supply Realized Price indicator suggests that the bull run will only reignite if BTC secures a sustained close above $28,233!”

Martinez is watching the Relative Strength Index (RSI), a momentum indicator that aims to determine if an asset is overbought or oversold.

“Bitcoin: In the past month, the four-hour chart RSI has been the real MVP for spotting those local highs and lows!

The strategy is simple: buy BTC when RSI dips below 30.35. Sell BTC when RSI exceeds 74.21.

Notice the RSI recently dropped below 30.35, signaling a potential buy-the-dip opportunity!”

Next up, the trader says that the Tom DeMark (TD) Sequential indicator, which traces a series of price points to signal possible trend reversals, is suggesting Ethereum could soon bounce.

“Ethereum is moving within a steady range. Interestingly, the TD Sequential presented a buy signal at the lower end of this range, suggesting ETH could rebound to $1,630.

But be cautious: if ETH closes below $1,530, the bullish outlook will be invalidated.”

Ethereum is trading for $1,536 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney