Top crypto exchange Kraken is warning Ethereum (ETH) investors that some on-chain metrics are suggesting further downside pressure on the second-biggest digital asset by market cap.

Kraken says via Twitter that an increase in ETH flowing into exchanges could mean that bears currently have the upper hand on the bulls.

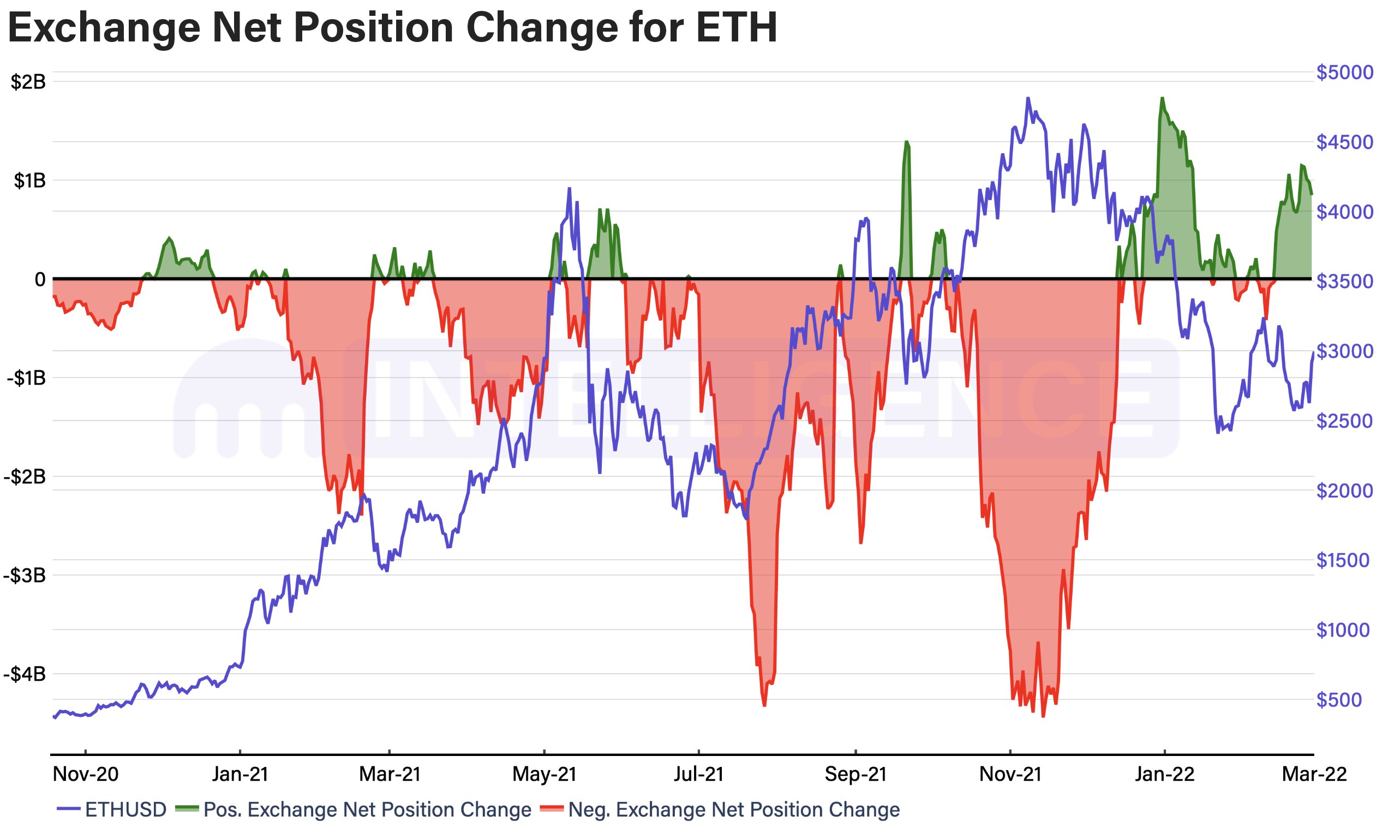

“ETH’s netflows on exchanges show that market participants are moving ETH onto exchanges, suggesting sell-side demand may be outpacing buy-side demand.

Should this trend continue, ETH’s price may drop as immediately marketable supply increases.”

Although Kraken is seeing signs of increasing sell-side pressure for Ethereum, the crypto exchange notes that one on-chain metric suggests that ETH is gearing up for a bounce.

Kraken says in a new report that Ethereum’s market value to real value Z-score (MVRV Z-score), which compares an asset’s market value to its realized value and is used to detect overbought or oversold conditions, is currently hovering in bullish territory.

“With ETH down almost -37.5% from all-time highs, the crypto asset’s MVRV Z-score reading of 1 indicates that ETH is in ‘oversold’ territory and is back on the rise. ETH’s MVRV Z-score confirms that ETH has entered a correction and could flip trends back to the upside soon as ETH infrequently falls this deep into oversold territory before prices rebound.”

Kraken also says that the effect of current uncertain macroeconomic conditions may be mostly priced into the crypto markets, with healthier price action starting to form again. However, the exchange says that a slight bearish edge to the crypto markets remains in play, with Ethereum currently looking more at risk than Bitcoin.

“It’s tough to confidently determine what’s ahead for the crypto markets. However, on-chain data currently paints a slightly bearish picture. Metrics such as exchange net position change show that market participants are potentially moving BTC and ETH out of long-term holding and into marketable supply. Namely, exchange net position change for BTC shows net flows accelerated positively throughout most of January but flipped trend to the downside in February.

The total exchange net position change for BTC is now +$13.5M over the past 30 days. ETH’s exchange net position change tells a similar story, though bearish momentum appears greater than BTC. ETH’s exchange net position change was +$874.5M over the past 30 days. Still, bearish momentum is slowing for BTC, while the opposite is true for ETH.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia