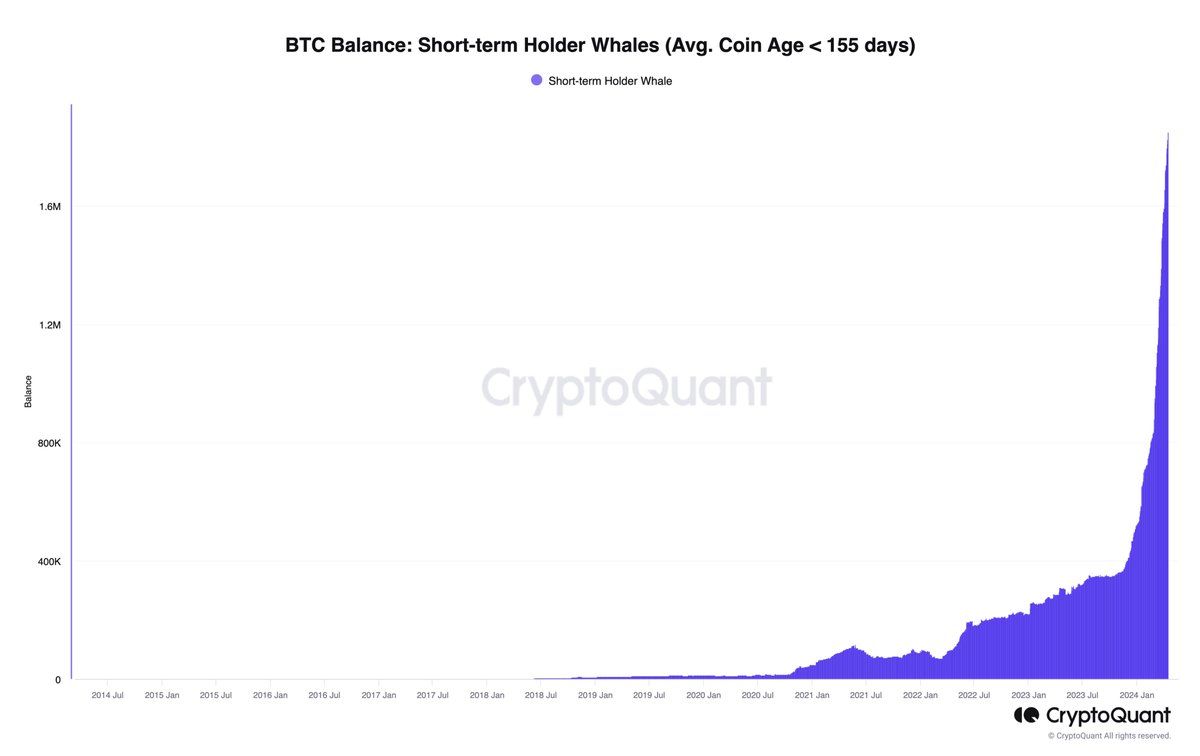

Newly created Bitcoin whales reportedly hold a record amount of BTC to the point of controlling 9% of the total supply of coins.

Ki Young Ju, CEO of blockchain analytics firm CryptoQuant, shares data showing that short-term holder Bitcoin whales have become one of the primary cohorts of entities.

Short-term holders are defined as those who have been holding their coins for less than 155 days.

“New Bitcoin whales now hold 9% of the circulating supply, totaling 1.8 million BTC, including spot ETFs.”

The CEO also says that despite a lull in demand for Bitcoin exchange-traded funds (ETFs), the accumulation of BTC on-chain remains “very active.”

“Bitcoin ETF demand has stagnated for 4 weeks, yet on-chain accumulation remains very active, even when excluding ETF settlement transactions.”

Bloomberg ETF expert James Seyffart notes that it’s standard for many ETFs – in fact, the vast majority – to have zero flows on any given day, as shares of the product will only be created if there’s a mismatch in supply in demand.

“Okay too many questions about Bitcoin ETFs and zero flows – a few quick thoughts:

1. On any given day, the vast majority of ETFs will have a flow number of ZERO – this is very normal. There are ~3,500 ETFs in the US. Yesterday 2,903 of them had a flow of exactly zero.

2. Shares are created or destroyed in creation units. This ONLY happens when there is a mismatch in supply in demand. And that mismatch has to be large enough to justify tapping the underlying market and a ~bigger mismatch than a creation unit.

3. Creation units are the lots that ETF shares are created and redeemed in. Every ETF can have a different sized creation unit. In the case of the spot Bitcoin ETFs they are blocks of shares ranging from 5,000 shares to 50,000 shares.

4. So, a creation or redemption will only happen if there is large enough mismatch in supply and demand AND the cost to make a market by doing that creation or redemption is lower than simply hedging and making markets the old fashioned way.”

At time of writing, Bitcoin is trading at $61,904, correcting from nearly $74,000.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Pattern Trends/S-Design1689