While the use of physical cash as a means of payment has been a long-term traditional finance method, crypto and digital payment infrastructures have gained widespread popularity due to their ease of use and relative security.

Different digital payment gateways spring up by the day offering innovative solutions, some of which offer decentralized services and a medium for users to get value from a plethora of investment options.

These new developments have changed the scene of the financial markets, with a growing number of individuals in the world’s population choosing a smarter way of handling personal finances and transactions without needing physical cash. We are now faced with salient questions. Will physical cash go extinct? Is crypto global adoption imminent?

The Future Of Payments-Cash Or Crypto?

According to a report by The Telegraph, the Bank of England fears that cash will become ‘less useable’ as the ‘high street’ goes contactless.

High Street, which is a common business/shopping hub in cities and towns in the United Kingdom, now increasingly rejects cash as a mode of payment from customers.

Related Reading: Shiba Inu Cofounder Clears The Air On Rumored Token For Shibarium Layer 2 Blockchain

Still on the report, the Deputy Governor of the Bank of England for financial stability, Jon Cunliffe has expressed concerns, saying that physical cash will become more difficult to spend in the years to come due to a spike in the number of online shopping stores integrating contactless payment gateways for customer transactions.

While physical cash suffers, these developments are a step in the right direction for crypto, as it exposes online shopping vendors and consumers to modern finance of ease and convenience.

Crypto adoption is gradually taking root as some countries including its citizens embrace this form of digital currency as a mode of payment transactions and a store of value.

For example, El Salvador, a country in Central America, fully embraced Bitcoin as a legal tender as seen on a news post aired by the popular Al Jazeera platform and other news media.

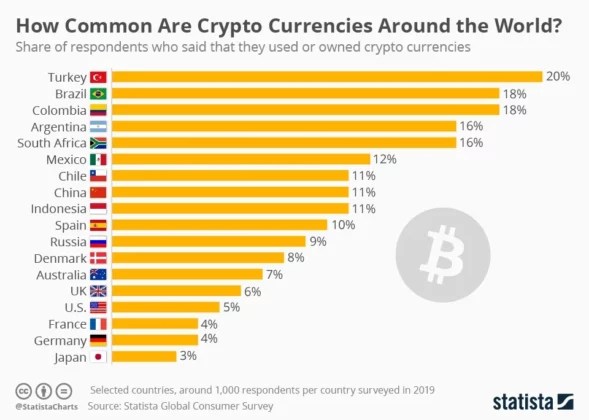

Although the majority of countries in the world are yet to take such bold steps as El Salvador, a teeming number of individuals from different countries incorporate crypto payments into their daily transactional activities.

The image below depicts some countries whose citizens own cryptocurrencies or have interacted with one or multiple crypto services.

Image Source| Statista

Crypto Market Gains A Measure Of Relief

The market recovery brought back a measure of excitement and euphoria in the previous week when Bitcoin bulls shot up the alpha crypto above the $30,000 region for the first time since June 2022.

Related Reading: Crypto Traders Rejoice: CME Boosts BTC And ETH Options With Daily Expiries

Bitcoin, at the time of writing, currently trades at $29,901 after a retracement from the $31,000 price mark due to bulls losing some steam. It will be interesting to see bulls recover and make up the markets by the end of the week.

BTC Eyes $30,000 on the daily timeframe| Source: BTCUSD on TradingView

Featured Image from Istock, Chart from TradingView.com