A widely followed crypto strategist is looking at one crucial metric with a history of accurately calling Bitcoin (BTC) bottoms.

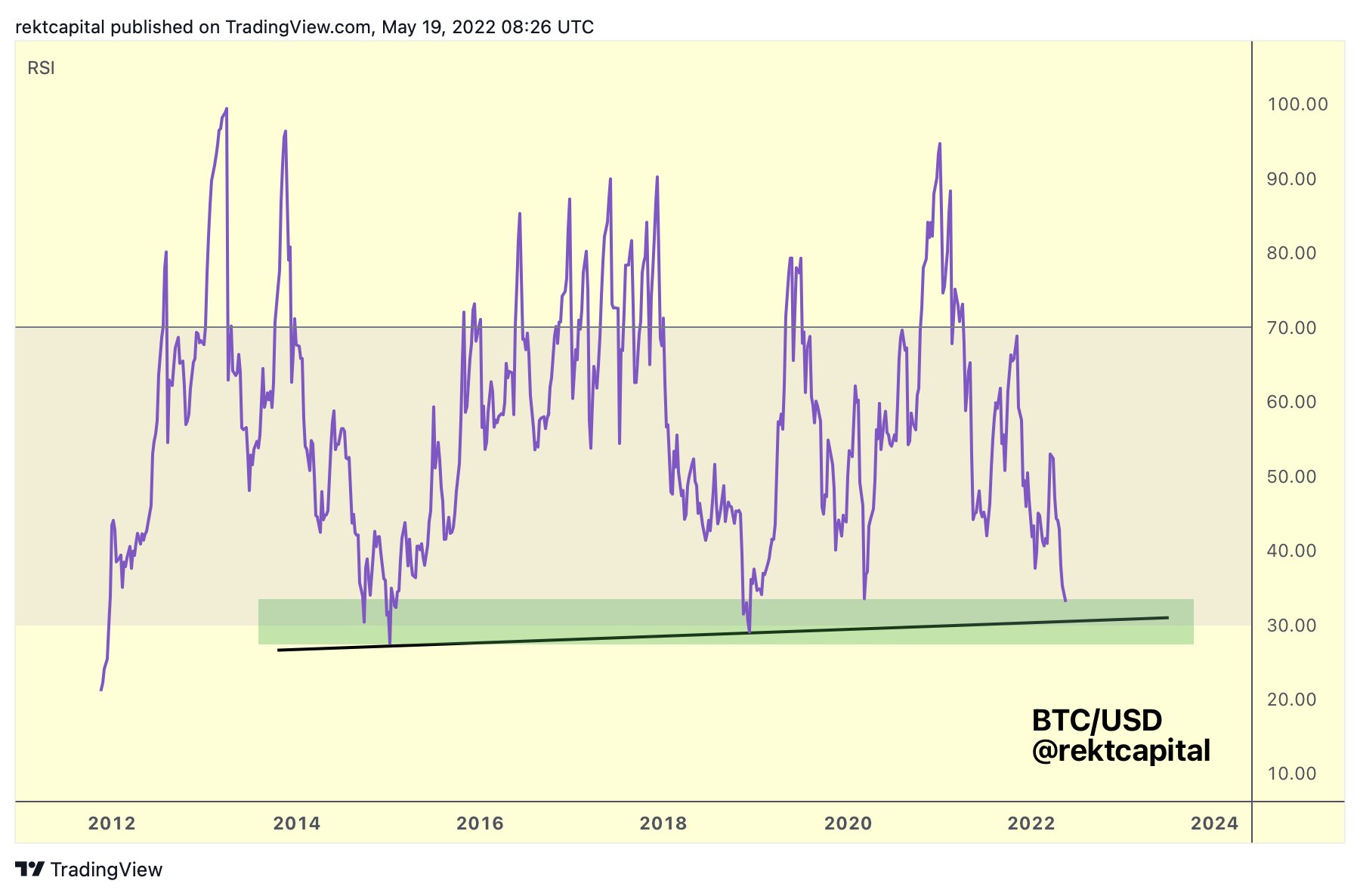

Pseudonymous trader Rekt Capital tells his 303,000 Twitter followers that BTC’s Relative Strength Index (RSI) is reaching a level that historically signals a bounce could be on the horizon for the top crypto asset by market cap.

“BTC’s RSI reaching March 2020 levels represents a best case scenario for a BTC bottom being very close.

However, RSI levels dipped much lower in 2015 and 2018 to reach a bear market bottom.

Should RSI levels go lower, [the] black higher low could be a point of reversal.”

An asset’s RSI is a momentum indicator measuring recent prices to determine whether it is oversold or overbought in a specific timeframe.

According to the crypto analyst, the previous three times Bitcoin’s RSI dipped to the area it is near now, a bear market bottom was found, igniting a recovery.

“Bitcoin RSI is now entering a period that has historically preceded outsized returns on investment for long-term investors.

Previous reversals from this area include January 2015, December 2018, and March 2020.

All bear market bottoms.”

Rekt Capital says that BTC’s RSI recently reached the same level it was in March 2020, before the leading digital asset kicked off a rally that saw it climb up all the way through the end of the year.

Bitcoin is changing hands at $29,302 at time of writing, a 6.5% decrease from its seven-day peak of $31,319.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Sutterstock/Kit8.net