Crypto has more pitfalls than an ’80s side-scroller, and forget “WAGMI” – we’re simply not all gonna make it. But the meme-loving asset class still has potentially attractive opportunities for those who look in the right places, bear market or not. Read on for no financial advice…

The chair of the US Securities and Exchange Commission Gary Gensler labeled crypto the “Wild West” of finance late last year – a fairly obvious, go-to metaphor. But largely unregulated as it has been for a long time, it does the industry a huge disservice to tar it as one big gambling den.

That said, many a crypto trader, flipper and even some HODLers do tend to refer to themselves with some pride as risk-embracing “degens” (more on that in a sec).

But while the high-risk, high reward/loss element remains strong in crypto, the space has also matured a good deal in the four and a half years since I first took notice with a small speculative purchase of Bitcoin and Ethereum (and, embarrassingly, a total rug-pull called Confido).

That maturation will likely gain pace as yet more institutions, sovereign states, and high-net-worth investors jump in and regulatory clarity ensues.

Degens and dollar-cost averagers

Gotta risk it to get the biscuit? Crypto has historically been as volatile an asset class as you can possibly find, outside trading Pokémon cards, crystal meth or maybe nuclear warheads. So, broadly speaking, it’s inherently risk-on.

But, as with all investing, there are different risk-level strategies to assume within that arc, depending on your tolerance and the amount of capital you’re prepared to lose. Here then, are two of the more commonly known, sometimes employed in tandem…

The degen strategy is actually probably better described as a mentality. Short for “degenerate”, in the crypto world “degen” is regarded less an insult and more a way of life. It generally describes investors who regularly “ape” in and out of various “sh*tcoins” (a loose term for mostly lower-cap altcoins), usually spending next to no time researching the investments.

That might sound a little pump-and-dumpy, but it’s not necessarily as darkly orchestrated as that (or as stupid as it sounds). It should be noted that while not much due diligence is given to research by degens, gaining a naturally quick feel for potentially lucrative projects can take some time. It’s a case of time in the market and timing. And luck.

Because investment opportunities in crypto and NFTs can shift at lightspeed, some do this as a kind of spray-and-pray thesis, hoping the wins outstrip the many losses, duds or even scams.

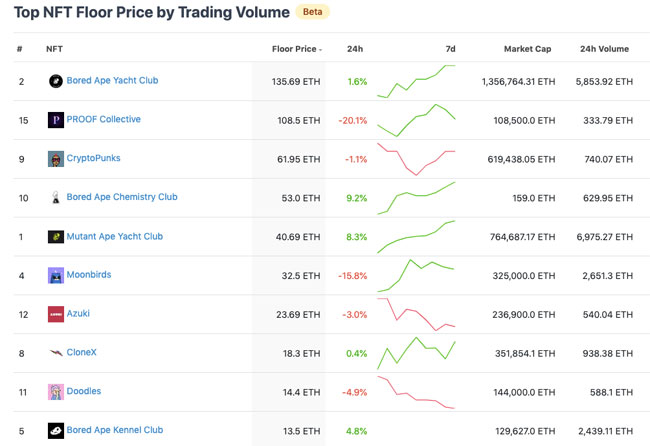

It’s worked spectacularly for those who managed to catch on to dog-meme coins such as Shiba Inu (SHIB) early doors, a Bored Ape Yacht Club NFT, or more recently Moonbirds (which has a floor price that’s risen from 2.5 ETH to 30 ETH at the time of writing – about US$90k). Easier said than done.

As for dollar-cost averaging (DCA), this is by far the safer, more conservative route, and involves investing a set amount of money in manageable increments at regular intervals. It’s commonly done with “blue chip” coins, particularly Bitcoin (BTC) and Ethereum (ETH).

For example, if you’d invested $20 AUD per week into BTC over the past four years, you’d have turned $4,160 into about $18,000. The same equation with ETH would put that investment at around $43,000.

Admittedly, the figures don’t look as hot if you adjust the time period to only the past 12 months, and there’s no guarantee we’re not heading into an extended bear market from here. But for those with a longer-term bullish crypto outlook, it’s probably a more sensible play than flipping jpegs on OpenSea.

New around here? Five things to consider and look out for

The staking opportunity

One of the biggest boons that crypto offers investors is the ridiculous levels of interest or yield that can be earned through DeFi, comparatively speaking, that is, to the trad financial world. We’re talking 5, 10, 15, even 20% per year on some cryptos and stablecoins.

There are various means to do this, with, again, various levels of risk. Many top exchanges (eg. Binance and Coinbase) offer crypto staking, which makes things easy, although it means handing over your crypto and they take a fee, natch.

The more decentralised options include staking your crypto from your own address directly into the protocol’s (eg. Avalanche, Cardano, Solana, Terra) staking platform or official wallet; staking through a third-party wallet such as Ledger cold storage; or through a staking-as-a-service provider such as RocketPool.

Airdrops

There’s no such thing as a free lunch… yada yada. But keeping your ear to the ground in crypto can help you find occasionally very lucrative opportunities. For example, the decentralised exchange Uniswap famously airdropped a minimum of 400 UNI tokens to every crypto address that engaged with its protocol by a certain date in 2020. At its peak, UNI grew to be worth US$44.92 per token. That’s nearly US$18,000 if you’d sold at the right time.

From time to time, Stockhead lets readers know about potential airdrop possibilities, which are essentially ways to receive free crypto tokens from decentralised projects either launching and dispersing or using the method as a marketing strategy.

But, by keeping your ear to the ground, we also mean keeping your eye on Crypto Twitter. We’ve found @OlimpioCrypto to be a pretty handy source, for example.

Be careful who you follow, though

Even the most dubious of intentioned crypto influencers will tell you they’re not a) financial advisers and b) that you should never invest more than you’re prepared to lose. Before absolutely shilling you the epitome of a sh*tcoin, such as Kasta.

If it sounds too good to be true in crypto… it’s usually being enthusiastically sold to you by a Tweeter or YouTuber who uses Home Alone-style shocked/amazed faces for video thumbnails.

There are some great crypto influencers, of course, but sorting the wheat from the chaff can be hard work. Note to self: it’s probably about time we attempted to do so for Stockhead readers.

Be wary of the HODL trap…

You gotta know when to HODL ’em, know when to… FODL ’em? To be honest, I’m still working this one out. But the well-worn HODL (hold on for dear life) mentality is something I subscribed to a bit too heavily for probably the first three years of my crypto-investing journey, and it cost me.

Made a 5X, 10X, or even 20X profit or more on a sh*tcoin? Yeah, probably best to at least pull out that initial capital, and then some. Then maybe “HODL” the rest and see where it goes.

… unless you’re stacking those blue chips

Of course, if you’re truly set on the Bitcoin and/or Ethereum long-term, financial freedom, inflation-hedge thesis, then HODLing and dollar-cost averaging is pretty much speaking the same language.

The author is not a professional financial adviser. Instead, he’s more set on making just about every mistake in crypto as a kind of ongoing social experiment.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter