Get a better understanding of how liquidations work in different lending protocols and find out multiple ways to keep your funds safe in adverse market conditions.

Dread them, run from them, liquidations still arrive. And liquidation bots won’t care if you borrowed funds to get your kid to college, to finally buy yourself a new set of wheels, or if you maybe had a mild leveraged long position open. No, they’ll hit you just the same, right as soon as your position dips below that minimum health threshold.

To be able to prevent this, let’s start at understanding what exactly we’re fighting against and why. And this is where things already start getting tricky, because the liquidation process and the outcomes can differ greatly depending on the lending protocol you’re using.

Here’s a brief rundown of how liquidations work in some of the most popular lending protocols:

- In Aave (both v2 and v3) liquidations will be up to 50% of your debt, with varying penalties (or bonuses, if you’re the liquidator) depending on the collateral asset used. This means that a liquidator can clear 50% of your position’s debt and get the same value of your collateral in return, with the appropriate bonus then added on top.

- In Compound v2 liquidations can be partial or complete, depending on what the liquidator decides. The penalty will also vary depending on the asset you used as collateral.

- in Compound v3 liquidations are for your complete debt amount, but the liquidator gets your full collateral assets and returns the remaining value (after applying your penalty/taking their bonus) in the base asset of the Compound v3 instance you’re using. So, in case of Compound v3-USDC, once your position with ETH as collateral and USDC as debt is liquidated, you’d actually be left with USDC supplied. How fun is that?

- In MakerDAO liquidations are complete, clearing your full debt, and they happen with a fixed liquidation penalty of 13% for all supported types (currently ETH, wstETH and WBTC). This means that the liquidator clears your full debt and gets back the 1.13x value of your collateral in return. Ouch.

- In Liquity liquidations under normal conditions (when your c-ratio drops below their 110% minimum) are complete. This means that your full debt is cleared, but you’re also left with no collateral leftover to claim whatsoever, as that small margin is split as incentives between the liquidator and Stability pool depositors. They also have liquidations that can happen if the protocol enters Recovery mode,

Some of these options are very painful and some are less harsh, but none of them are desirable.

So let’s talk about ways to keep your positions safe and out of the hands of pesky liquidators.

#1 – Position health alerts

The first step to preventing liquidations is being aware of the state of your position. While you could just never sleep (imagine sleeping in this economy) and watch the state of your positions in DeFi 24/7, there are easier ways.

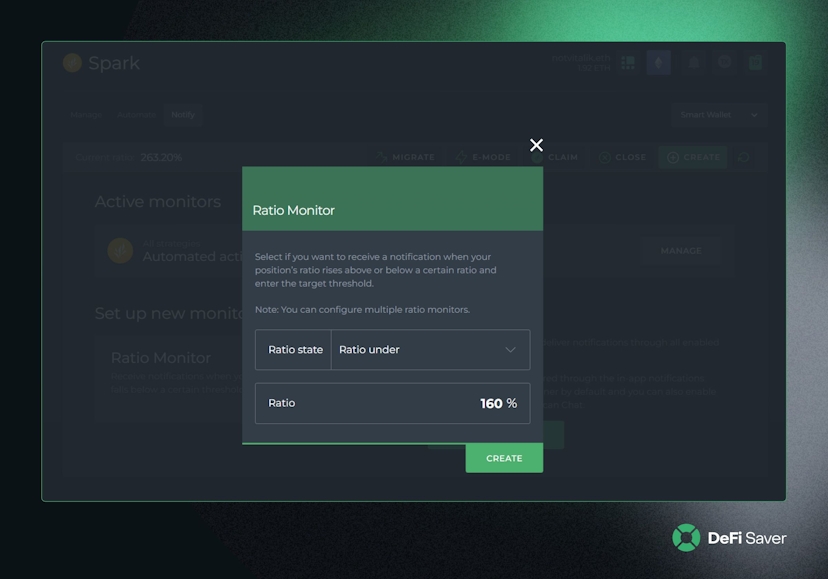

If you’re using any of the most popular protocols (including the likes of Aave, Compound, Spark, Liquity), you could easily set up position health alerts using DeFi Saver and have them sent to you via email or Telegram.

Once you do get an alert, though, you’ll need to consider your next steps. We have a few options to suggest.

#2 – Self-liquidation or partial unwinding as a means of protection

When it comes to actual actions to keep yourself out of the hands of the liquidators, this is the oldest trick in the book.

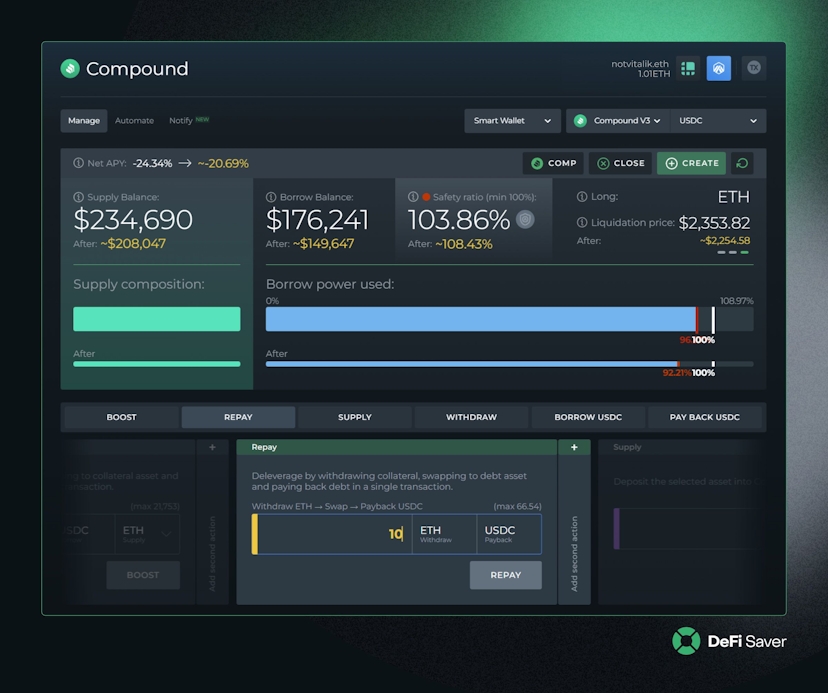

Some call it unwinding, others call it self-liquidation, but in essence what you can do is use your existing collateral, the funds that are already within the position, to clear some of your debt. Since all of these positions are overcollateralised, this will effectively mean that your health ratio moves up, getting you to safer territories.

And where DeFi Saver makes this super easy is by turning this otherwise 3-step process of withdraw-swap-payback into one single transaction that does the whole job for you.

This does involve selling, though, so if that’s something you’d rather avoid, here comes another option.

#3 – Moving to a protocol with a higher LTV

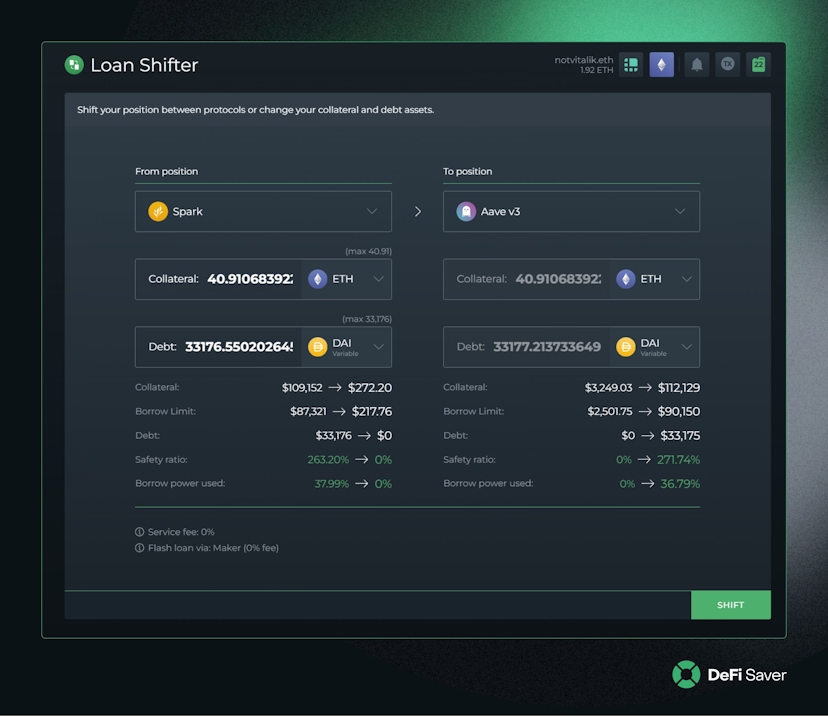

Another action you could make to get out of the way of a liquidator bot is move your whole position, as is, to a completely different protocol with a higher allowed LTV.

I feel like many people still don’t know this is possible, but it’s one of the options that highlights the beauty of DeFi interoperability the best for me.

This is something that’s made possible thanks to flash loans, which are used in this process to clear your debt and free your collateral to be moved elsewhere. And once the collateral is moved, the same borrowing is made and used to clear that initial flash loan. That may sound complex, but once again it’s something that you can do in one quick transaction using DeFi Saver.

Just to keep your expectations realistic, though – chances are you won’t find a protocol that allows a drastically higher LTV, but there might be an option that just lets you go through this one market correction without having to sell anything.

#4 – Automated liquidation protection options

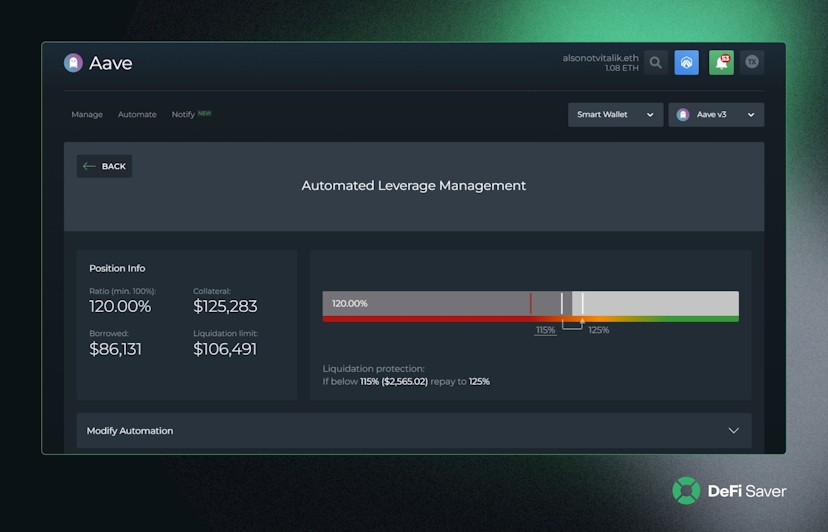

Finally, if you’re looking to take some time away from your keyboard and wallet, you may want to look into automated liquidation protection options. And luckily for you, automation features for DeFi lending protocols have been the flagship feature of DeFi Saver for years now.

With support for Maker, Compound, Aave, Spark, Liquity and Morpho Blue, you get access to a number of automation options, though two have proved to be most popular so far: automated unwinding & stop loss.

Automated unwinding does exactly what you’d expect from the name, it uses a bit of your collateral to clear some of the debt. Just like with manual unwinding, the outcome will be a slightly deleveraged and slightly safer position.

Similarly, stop loss is also as straightforward as you’d imagine. The difference being that instead of partially unwinding, it fully closes your position once your set threshold price is hit.

Important to note that all these options are fully non-custodial, with you staying in control of your assets at all times. And perhaps also important to note that this is available across Ethereum mainnet, Arbitrum and Optimism, but more on that below.

#5 – The extra tip – don’t die to gas fees

Having lived through a number of major market crashes, including Black Thursday 2020 & May 16 2021, both as a defi user and someone who provides support to users of a defi app, I have to highlight that there’s one thing that people often completely forget.

The network is the most congested during the largest market crashes.

And this means that this is when transaction fees will be the highest. Gas prices of above 500 Gwei are a regular thing during such events, so remember that transaction you paid 0.02 ETH yesterday at 20-ish Gwei? That will now be 0.4 ETH, thank you very much. And then imagine this transaction reverting because it took 2 minutes to get picked up because of the congestion and you have to send another one. With another 0.4 ETH gas fee.

So why am I highlighting this? Well because this cycle, if you’re sticking to the Ethereum ecosystem like me, you have the option of using L2 networks which will have massively lower transaction costs. And I would suggest checking some of them out before deciding to open your next position in a lending protocol.

For example, Arbitrum has done a brilliant job of attracting liquidity and can definitely be considered even if your size is size.

But even if you’d rather stick to mainnet, you should at least be aware of this and know when to keep your position at low leverage and far, far away from liquidation to avoid having to participate in the madness.

That’s all I had in store for you today. I hope it was useful and, until next time, stay safe out there.🙏

Useful links:

- DeFi Saver website: https://defisaver.com/

- Twitter: https://twitter.com/DeFiSaver

- Farcaster: https://warpcast.com/defisaver

- Blog: https://blog.defisaver.com/

- Discord: https://discord.com/invite/XGDJHhZ