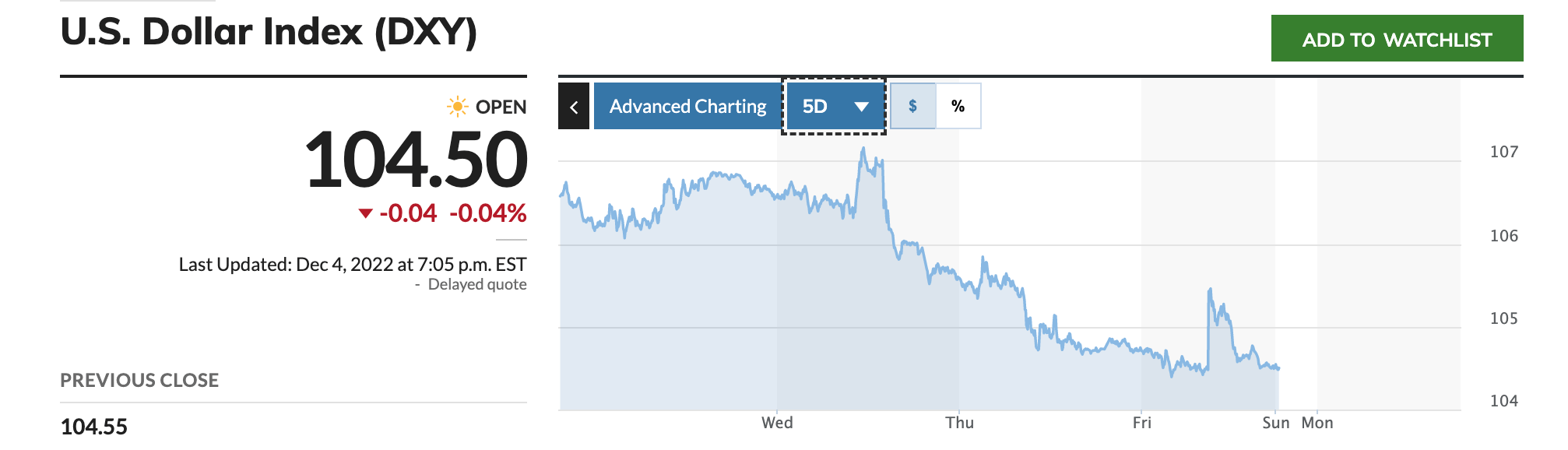

The US Dollar and its index (DXY) is looking dumpier than a Taco Bell loyalty member, which is a pleasing sign for the likes of Bitcoin and Ethereum.

Simplistically, greenback goes down, safe-haven assets such as gold have been known to go alright… and sometimes riskier stuff like crypto, too. Hardly a foolproof equation, but one that’s certainly played out before, bar the odd black swan complicating matters.

$DXY Breaking bearish.

Probably nothing… pic.twitter.com/UkcLN6Tvc0

— Crypto Rover (@rovercrc) December 4, 2022

And as the dollar declines, trading just north of US$17k and US$1,200 respectively, Bitcoin and Ethereum appear to be keeping their heads above very choppy waters for the moment.

If that vague thesis for BTC and ETH holds, there’s a chance we might see them build from that platform into something of a “Santa rally”, especially if next week’s US inflation CPI data for November comes in a little cooler than previous months, indicating a slowdown in inflation.

But… as boring as it’s already become to talk about in crypto circles, the FTX contagion – particularly as it relates to the Genesis, Digital Currency Group (DCG), Grayscale and Gemini nexus – is still a lurking dark cloud that has the potential for further crypto market roiling.

The Financial Times reported over the weekend that crypto broker Genesis and its parent company DCG owe users of the Winklevoss twins’ crypto exchange Gemini US$900 million. Gemini is apparently trying to recover the funds.

“Gemini’s bid to recover the funds underscores how the crypto lending market, where investors lend out their coins in exchange for high rates of return, sits at the centre of the industry’s credit crunch,” noted the FT.

Nevertheless, as Kiwi on-chain crypto analyst Willy Woo points out, at the heart of crypto investing, it’s very, very hard to break the faith of the Rick “Never Gonna Give You Up” Astley Bitcoin HODLers.

If you’re wondering why BTC is holding up against so much deleveraging, it’s the long term hodlers, the Rick Astleys who aint giving up their BTC, that are absorbing the sells. Buying spot and adding to their stack. pic.twitter.com/eOxmTsN0vk

— Willy Woo (@woonomic) December 4, 2022

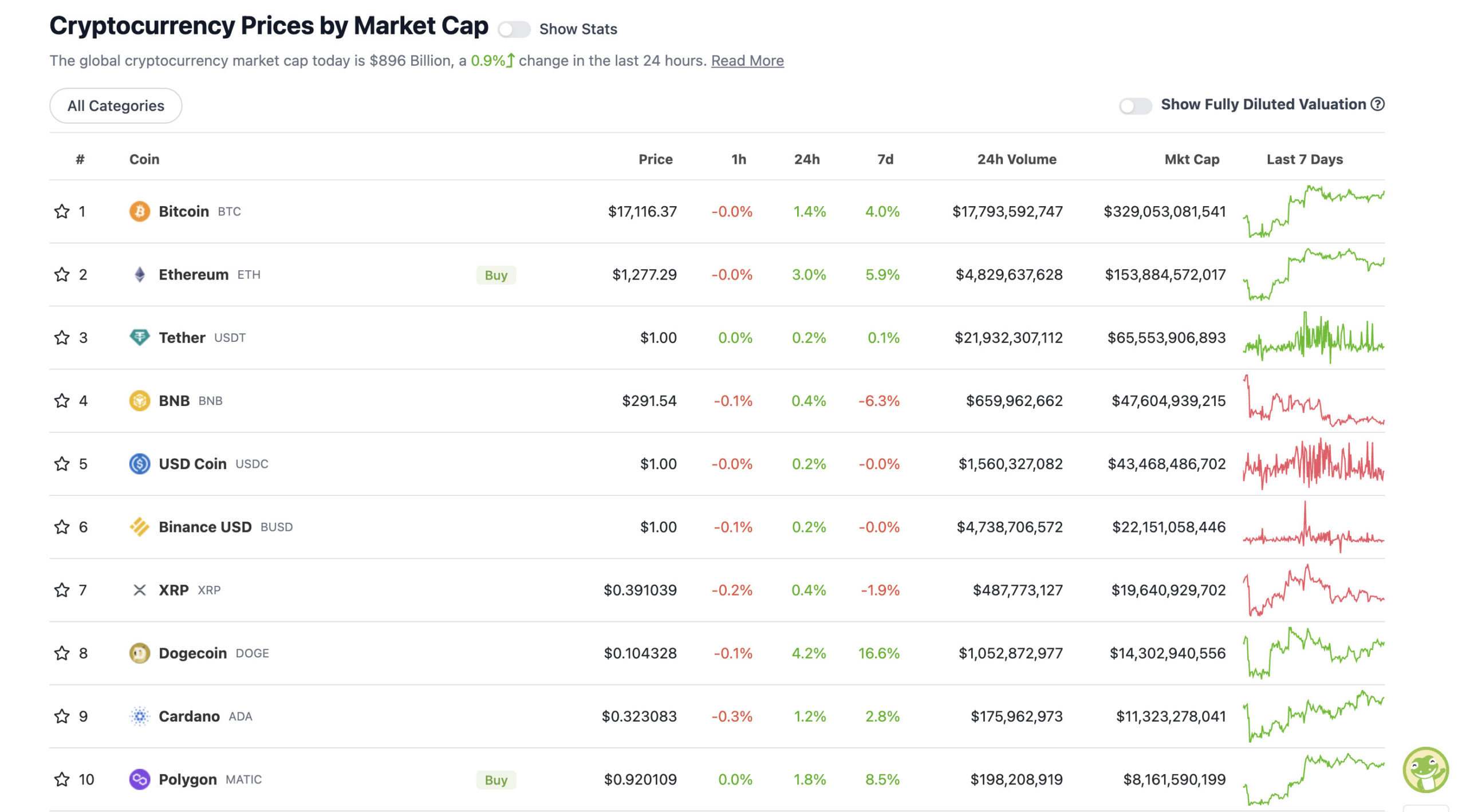

Top 10 overview

With the overall crypto market cap at US$896 billion, up about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

No movers of huge significance in the top 10 over the past few days, although Dogecoin is still holding onto gains it’s made over the past fortnight. As long as Elon Musk is in the news, as long as rumours of DOGE becoming the native cryptocurrency for Twitter swirl, then it’s likely to remain a volatile top-10 presence.

Doge is the next doge. pic.twitter.com/WXRueMKUJ6

— Mati Greenspan (@MatiGreenspan) December 4, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.57 billion to about US$331 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Celo (CELO), (market cap: US$347 million) +23%

• ImmutableX (IMX), (mc: US$364 million) +6%

• Curve DAO (CRV), (mc: US$434 million) +5%

• Flow (FLOW), (mc: US$1.17 million) +5%

• Internet Computer (ICP), (mc: US$1.18 million) +4%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$821 million) -3%

• Monero (XMR), (market cap: US$2.6 billion) -2%

• Huobi (HT), (mc: US$871 million) -2%

• Dash (DASH), (mc: US$494 million) -1%

• Tron (TRX), (mc: US$4.9 billion) -1%

Around the blocks

A selection of rumour, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

pic.twitter.com/2Ft1QiDR6D

— PΞtΞr (@NFTWizart) December 4, 2022

The thing is that people literally don’t want to buy #Bitcoin right now as they are feared.

The point is, that’s actually the best moment to start accumulating #Bitcoin.

Fundamentals didn’t change.

— Michaël van de Poppe (@CryptoMichNL) December 4, 2022

Now, what’s this. Former CEO of FTX’s trading firm Alameda, Caroline Ellison, appears to have been spotted in New York. If that’s her (and it’s unconfirmed), it quashes widely circulated Crypto Twitter rumours she’s been hiding out in Hong Kong or Dubai or elsewhere amid the FTX/Alameda collapse.

Caroline Ellison was spotted at a coffee shop in SoHo, Manhattan today.

So definitely not in custody and seemingly not in hiding 👀 pic.twitter.com/rqkYtYtq1e

— Crypto Crib (@Crypto_Crib_) December 4, 2022

pic.twitter.com/d6vPyP8SXQ

— Cobie (@cobie) December 4, 2022

Whether it’s Ellison or not, it’s fuelled speculation that she could be in New York to provide information to US authorities regarding Alameda’s role in the collapse of FTX and the alleged misuse of billions of dollars of customer funds.

It already is – still moving forward now:

– protocols

– decentralization

– hash rate

– memesNot moving forward:

– regulators

– cex/centralized institutions

– scammers— janky money (@0xFax) December 4, 2022

Stuff happens… pic.twitter.com/EsueSGVeL3

— Sven Henrich (@NorthmanTrader) December 4, 2022

Sponsored Articles